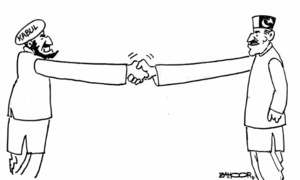

High-risk countries approach China for debt relief

ISLAMABAD: Following in the footsteps of Pakistan, many high-risk countries who are part of the ambitious Belt and Road Initiative (BRI) have approached China for debt relief, the Financial Times reported.

Last month, Pakistan requested China for ease in payment obligations of over $30 billion of about 12,000-megawatt power projects under the China-Pakistan Economic Corridor (CPEC) to minimise its financial and economic difficulties, the newspaper reported. This was part of government efforts to secure discounts and savings on power purchases from independent power producers (IPPs) as circular debt liabilities cross Rs2 trillion.

Early this week, the Economic Coordination Committee (ECC) of the cabinet authorised the Economic Affairs Ministry to negotiate debt relief with 11 bilateral lenders, including China, under a G20 initiative to suspend for about a year the payment of debt and its interest. Pakistan has to pay about $615 million to China between May 2020 and June 2021 under bilateral debt. The Chinese ambassador to Pakistan has since held a couple of meetings with Economic Affairs Minister Khusro Bakhtiar and Adviser to the Prime Minister on Finance Dr Hafeez Shaikh.

Pakistan had formally taken up its difficulties with China for relief in purchase prices at the highest level during the recent visit of President Arif Alvi to Beijing, as Pakistan’s capacity payments alone were estimated to be closer to Rs600bn this year, and estimated to go beyond Rs1.5 trillion in a few years.

Pakistan has requested two basic relaxations in the existing agreements given the emerging challenges amid economic meltdown across the world in the wake of Covid-19. First, Pakistan desires to bring down mark-up on debt to London Interbank Offer Rate plus two (Libor+2) per cent from the existing average of about Libor+4.5pc.

Second, Pakistan has sought an extension in debt repayment period in the tariff to 20 years from the existing repayment period of 10 years. Almost all the power sector projects in the country have upfront 10-year debt repayment in their tariff structure. The two discounts are estimated to save about $500-550m (more than Rs85bn) annual cash outflows.

“China has received a wave of applications for debt relief from crisis-hit countries included in the “Belt and Road Initiative” as coronavirus strains the world’s biggest development programme,” reported FT quoting Chinese policy advisers, adding that Beijing was considering a number of responses, including the suspension of interest payments on loans from the country’s financial institutions. But they also warned against expectations that China would forgive debts outright.

Published in Dawn, May 1st, 2020