KARACHI: The inflows of remittances in Ramazan have declined significantly due to the coronavirus pandemic forcing overseas Pakistanis to spend less amid fears of losing their jobs, said currency dealers on Friday.

Ramazan traditionally has been a month for higher remittances but the coronavirus has reduced the inflows. “It’s been a difficult month for remittances as inflows have not increased the way they did in the last many years,” said Forex Association of Pakistan President Malik Bostan.

He said remittances in April and May FY19 were $114 million and $157m, respectively but dropped to $100m in the outgoing month - reflecting the declining trend.

Since most of Ramazan fell in May, remittances should have been increased this month but currency dealers said it was hard to receive even $100m.

“Despite higher inflows due to Zakat and other charities, remittances were much less in Ramazan,” said Bostan.

Remittance from banking channels showed 5.5 per cent growth in 10MFY20. However, there was a month-on-month decline as the country received $1.79 billion in April compared to $1.894bn in March. The figures suggest that even the arrival of Ramazan could not improve inflows.

Exchange Companies Association of Pakistan’s former chairman Zafar Parcha maintained that inflows have been declining due to uncertainty in countries where Pakistanis are employed.

He said the oil-dependent countries have been facing shortage of earnings which resulted in job losses, creating uncertainty for a lot of Pakistanis.

For the last three months, manpower export from Pakistan is almost zero, said the dealers. Most of the unskilled countrymen get low-paid employment in the Middle Eastern countries but the coronavirus has hurt changed that.

The International Monetary Fund has predicted greater loss of remittances for countries like Pakistan during this calendar year. Media reports indicated that thousands of overseas countrymen have already lost jobs in the Middle East and are awaiting to return home.

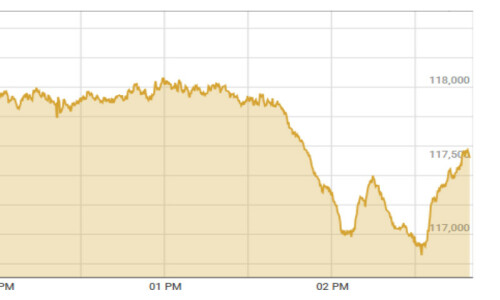

However, currency dealers said the low inflows in Ramazan would not impact the exchange rate which has now stabilised after appreciation of the dollar last month. The country has improved its foreign exchange reserves and might further strengthen the reserves buffer if it succeeds to defer debt servicing for one year.

Pakistan is likely to get a debt servicing waiver from G20.

They also said the overseas Pakistanis were not selling their holdings in the open market, reflecting their increased cautiousness. The selling of foreign currencies (like Dirham, Riyal etc) in the open markets are taken to Dubai to buy dollars against these.

Published in Dawn, May 23rd, 2020