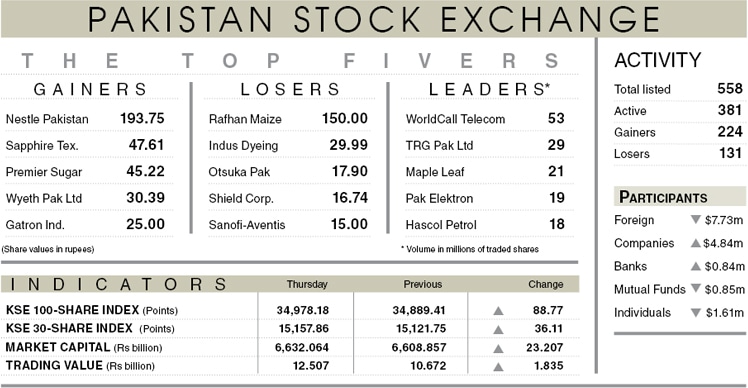

KARACHI: Investor interest in the equities was witnessed for the fourth successive day where the KSE-100 index climbed by 88.77 points (0.25 per cent) and closed at 34,978.18.

The index remained around the 35,000 level but it turned out to be big psychological barrier. The market opened in the green and surged to intraday high by 287 points assisted by cement, banking, oil and gas marketing companies, exploration and production, and automobile sectors. On international front, global equities mostly remained in green territory on account of rising oil prices.

Money appeared to be flowing in equities after the government disallowed financial institutions from investment in National Saving Schemes from July 1. The index doddered at the high levels for most part before dropping in about the last hour as individuals took profit for the second day and institutions also decided to err on the side of caution.

But perhaps the major blow came from foreigners who liquidated positions to the tune of $7.73 million. Companies deployed surplus cash amounting to $4.84m as they started to build portfolio for the following year. Insurance also ploughed $2.99m which helped to neutralise foreign sell-off.

Investors, who also thought that the stock were heavy after four days of continuous gains, shed some weight in the face of upcoming financial results for the quarter ended June 30. Due to the losses caused by lockdowns to counter the coronavirus, market expectations for corporate profitability was generally on the lower side.

Interest was observed in major financials where MCB, Bank Al Habib, United and Habib Bank contributed 65 points to the index. Cement, fertiliser, pharma and steel sectors also saw heavy participation with most scrips ending in the green.

The volume increased 22pc to 383.1m shares, from 315m. Stocks that contributed positively to the index included Nestle, up 20 points, MCB 19 points, United Bank 18 points, Bank Al Habib 18 points and Engro Fertilisers 14 points.

Published in Dawn, July 3rd, 2020

Dear visitor, the comments section is undergoing an overhaul and will return soon.