KARACHI: Stocks tumbled on Thursday as a sequel to announcement of reserved judgement by the Supreme Court which declared that the Gas Infrastructure Development Cess (GIDC) was required to be paid by corporates in the state’s exchequer.

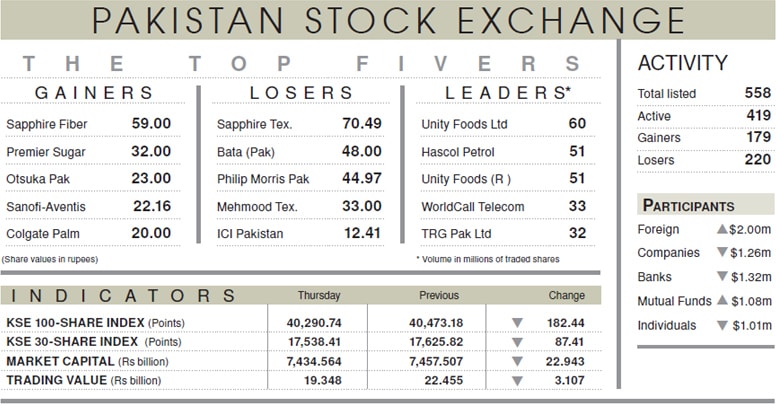

The index spiralled downwards to intraday low by 575 points but managed to recover greatly as it was supported by the exploration and production, oil and gas marketing companies and technology stocks. The benchmark closed with a loss of 182 points (0.50 per cent) at 40,473.

As the GIDC involves payment of a huge Rs457 billion over a period two years, nervous investors started to jettison shares mainly in the sectors worst impacted by it. The market which had started on a positive note with gains of 70 points, went around full circle as the shares fell like ninepins.

Fertiliser, cement and banking stocks received severe beating. Investors were also disinclined to hold on to their portfolio with three-day holiday ahead. The volume declined 6pc over earlier day to 556 million shares, from 591m while traded value fell 14pc to reach $115.2m.

It was yet again noticed that foreigners turned net buyers for the third day in a row with net purchases worth $2m. Most institutions and individuals were sellers but mutual funds cherry-picked blue chips which at midday pushed forward the index in the positive trajectory to intraday high of 91 points.

Sectors contributing to the day’s dismal performance were fertiliser, lower by 201 points, investment banks 27 points, banks 19 points and textile 19 points. Cement and E&P were the major movers. In the former, Maple Leaf, Pioneer and Cherat gained values while in the latter, Oil and Gas Development Company, Pakistan Oilfields and Pakistan Petroleum closed in the green zone as international crude prices were on the rise.

Among scrips, Fauji Fertiliser, dipping 6.3pc, Engro Corporation 2pc, Engro Fertiliser 2.8pc, Habib Bank 1.1pc, Dawood Hercules 2.5pc and MCB 1.6pc were the main losers.

Published in Dawn, August 14th, 2020