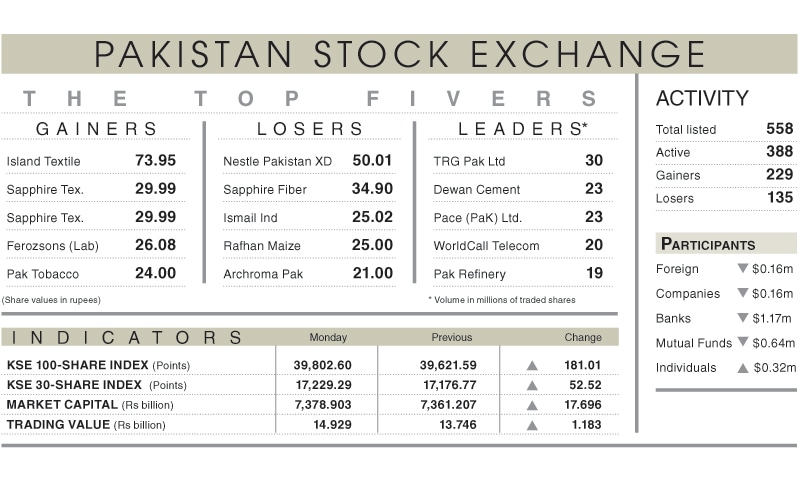

KARACHI: The stock market was back to winning ways on Monday after considerable losses suffered the previous week. The KSE-100 index gained 181 points (0.46 per cent) and closed at 39,802.

The index moved up quickly in the last hour after drifting sideways for most of the day, making the intraday low and high at 148 and 203 points. The range-bound behaviour of the market was thought to be the investors’ concerns of taking fresh positions in the future contracts’ rollover week.

Some sectors turned green in the final hours including cement, pharmaceutical, technology and automobile which helped index to perk up. The positive news flow also helped as the State Bank of Pakistan announced a current account surplus in July amounting to $424 million, as against deficit of $613m in the same month of 2019 and $100m in outgoing June.

The major reason for the switchover was thought to be higher remittances received during July. Foreign investors sold shares worth $0.16m. Most other local institutions also thought it prudent to book profit. However, the liquidity was mopped up by Brokers Proprietary Account and insurance. The volume stood down 7pc over the previous session to 371m shares while traded value amounted to $89m, up 9pc.

Exploration and production sector closed 1.3pc lower with Pakistan Petroleum, Oil and Gas Development Company and Pakistan Oilfields shedding values on concerns over the slight drop in international oil prices and as Cabinet Committee on Privatisation approved divestment of part of government holdings in the former two.

In cement, Lucky, DG Khan, Cherat and Pioneer closed stronger in anticipation of higher despatches. Other gaining scrips were TRG, Dawood Hercules, National Bank and Pakistan State Oil.

As the market correction was complete, investors taking a slightly mid-term outlook were looking forward to financial results mainly in the cement companies which had come to benefit from the government’s initiatives in the construction sector.

Published in Dawn, August 25th, 2020

Dear visitor, the comments section is undergoing an overhaul and will return soon.