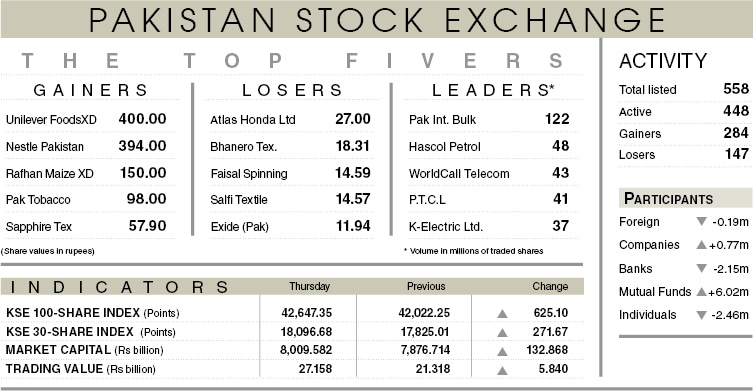

KARACHI: Stocks staged a grand rally on Thursday with the KSE-100 index making a giant stride of 625.10 points (1.49 per cent) and closing at 42,647.35.

The strong performance was underpinned by the recovery in global equity markets, uptick in international oil prices and bulk buying by mutual funds who were shifting cash from money market funds to the intensely bullish equities.

The market started to trade after opening higher by 200 points. The index touched intraday high by 655 points and closed slightly short of that mark, depicting firm hold of the bulls.

Analysts at Arif Habib Ltd said the market performed in response to the pick-up in Roshan Digital Account for Non-Resident Pakistanis (NRP) that would facilitate investment by diaspora in PSX shares as well as government securities.

Foreign investors sold shares valued at $0.19 million. Most local participants including individuals also booked profit. Mutual Funds however were the lone big buyers who purchased shares worth $6.02m.

The volume increased 25pc over the previous day to 885m shares while traded value also rose by 27pc to reach $163.2m. Among scrips, Pakistan International Bulk Terminal, Worldcall, Hascol Petroleum and PTCL cumulatively contributed 254m shares to the aggregate turnover.

Activity was seen across the board but was more pronounced in oil and gas marketing companies, exploration and production and banking sectors. Pakistan State Oil traded near upper circuit, whereas Oil and Gas Development Company, Pakistan Petroleum and Pakistan Oilfields turned green on rise in international oil prices.

Fertiliser sector also showed positivity as high court granted stay on Gas Infrastructure Development Cess collection. Fatima, Engro Fertiliser, Engro Corp and Fauji gained to close higher. In banking, MCB, Alfalah, United, and Habib closed in the green region.

Major scrips that carried the index higher included Lucky Cement, up 3.3pc, MCB 3.6pc, Hub Power 3pc, Pakistan Petroleum 3.3pc, Habib Bank 1.5pc and Pakistan State Oil 4pc.

Published in Dawn, September 11th, 2020

Dear visitor, the comments section is undergoing an overhaul and will return soon.