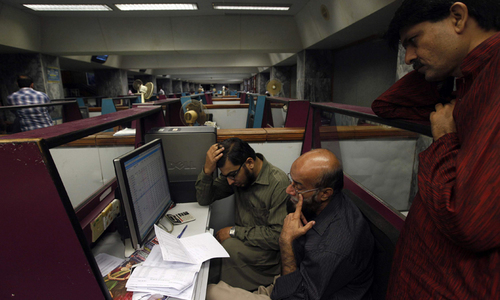

KARACHI: The stock market was dragged down in another choppy trading session on Wednesday which saw the KSE-100 index decline by 64.14 points (0.15 per cent) to close at 42,282.28.

The index opened positive and reached intraday high by 198 points. It later moved responding to the “breaking news” with decreased investor participation.

On the positive side, the improved growth projection of Asian Development Bank for Pakistan’s GDP by 2pc in FY21 coupled with improved large-scale manufacturing output, elated sentiments.

However, those were eclipsed by the SBP announcement of Monetary Policy Statement for next two months on Sept 21, which kept investors cautious later in the day. A poll conducted by Arif Habib Ltd among financial and corporate members resulted in 83pc of total respondents suggesting that interest would be kept unchanged at 7pc; 57pc expecting rate cut between 25-50 basis points.

The index fell to intraday low by 254 points, before breaking back in the green but pushed out into the red just before close. Developments on the Financial Action Task Force also kept investors’ interest seized by the issue.

The session was marred by the news of FATF bill that required parliament’s approval and expectation of a repeat of the previous vote by the opposition that refused to sanction the bill, caused some nervousness among investors who decided to quit and watch from the sidelines.

Foreign investors sold shares worth $1.16 million. Brokers were other major sellers. However, mutual funds, insurance companies and individuals kept up picking stocks at dips.

The volume plunged 26pc to 490 million shares, from 662.8m while traded value also declined by 21pc to $87.9m. Banks, oil and gas marketing companies, pharmaceutical and steel sectors saw selling pressure, whereas fertiliser and cement performed well. In the former, increase in DAP prices led Fauji Fertiliser Bin Qasim to close 3.9pc up. Cement stocks also remained generally green on news of price increase in the North.

Published in Dawn, September 17th, 2020