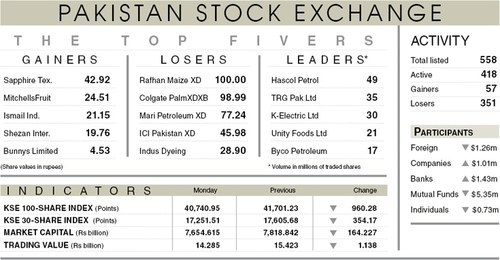

KARACHI: The stock market managed to plug the heavy losses suffered on Wednesday and crawl up by 105.44 points (0.26 per cent) to 40,676.72 in the final moments before close.

Trade remained otherwise choppy for most of the day where the index travelled between the intraday high and low by 164 points and 458 points.

Investor enthusiasm to dabble in stocks was lacking due to absence of positive triggers while concerns over several factors continued to sit on their mind, dissuading them to take fresh positions.

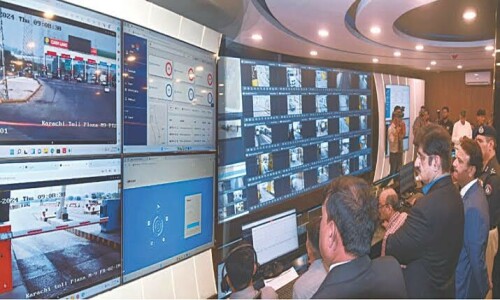

Traders said that volatility was fuelled by fresh micro smart lockdown imposed in Karachi to contain the breakout of new coronavirus cases. Investors also remained anxious over the upcoming September inflation figures and the Financial Action Task Force’s decision on Pakistan status to be declared in October.

However, a major reason for investors to jump out of stocks was the rising temperatures on the political front, where defiance by the opposition was instrumental in causing political instability.

Foreign outflows trickled down to $0.17 million. The redemptions from mutual fund investors continued where the funds liquidated shares worth $3.67m. Individuals also decided to take profit by sale of shares valued at $5.63m. Banks and insurance turned value hunters and picked up attractively priced blue chips.

The “market has lost roughly 2,000 points from its recent highs and in the process has brought attrition in cement, steel and banking sector scrips,” stated report by Arif Habib Ltd.

The volume declined by 22pc to 371m shares, from 473.8m a day earlier. Traded value also dropped by 19pc to reach $75.8m. Leaders were Hascol Petroleum, K-Electric, Unity Foods, TRG and Pakistan International Bulk Terminal.

Financials, exploration and production, and cement supported the index in the latter half. Major gainers where United Bank, Habib Bank and MCB among banks which collectively contributed 88 points. Oil and Gas Development Company and Pakistan Oilfields in E&Ps and Pakistan State Oil among the oil and gas marketing companies also supported the index.

Published in Dawn, October 2nd, 2020

Dear visitor, the comments section is undergoing an overhaul and will return soon.