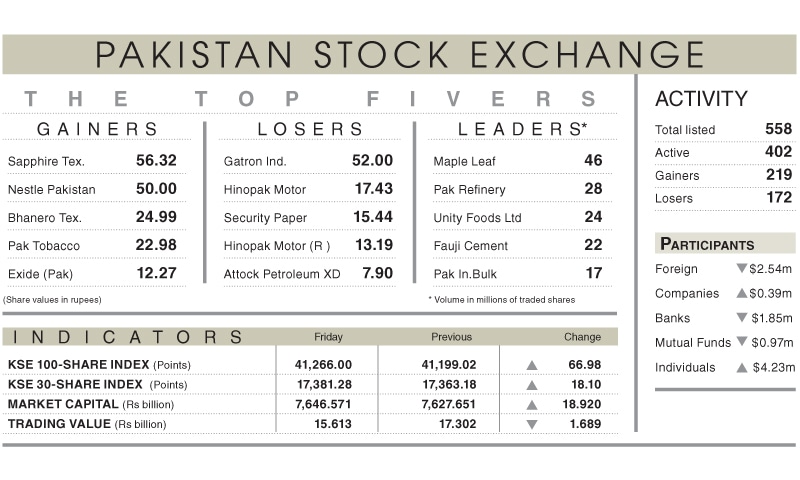

KARACHI: The stock market on Friday traded range bound but managed to crawl up by 66.98 points (0.16 per cent) and close at 41,266.00.

The market remained in search of direction throughout the day. The murky political situation together with the long wait for the Financial Action Task Force verdict sat heavily on the minds of stockholders.

Earlier in the day, some suggestions of a possible slip into the blacklist spooked investors who ran to cover their positions. They were further disinclined to hold on to their portfolio over the weekend into the roll-over week.

The index moved in the range of intra-day high and low by 184 and 135 points mainly as the sentiments changed with the announcement of corporate results.

Traded volumes declined further by 29pc to 354.4 million shares while the traded value also declined by 10pc to $96.8m from $107. 2m the previous day.

Stocks that contributed significantly to the volumes included Maple Leaf Cement Factory (MLCF), Pakistan Refinery Ltd, Unity Foods Ltd, Fauji Cement Company Ltd and Pakistan International Bulk Terminal Ltd, which formed 39pc of total volumes.

Foreign investors sold shares worth $2.54m. Among local participants, banks and mutual funds decided to take profit. Individuals remained unguarded and accumulated mainly the second-tier stock worth $4.23 at dips.

Analyst Ahsan Mehanti commented that data of current account surplus by $73m during September, owing to growth in exports, higher remittances and upbeat corporate results played a catalyst role in bullish close.

Corporates produced better-than-expected financial results in cement, banking and fertiliser sectors. Investors showed little interest in the exploration and production companies which turned weaker regardless of the stable crude oil prices in the international markets.

Analyst at Topline calculated that the scrips that contributed mainly to the index gains included Lucky Cement, Engro Corporation Ltd, Cherat Cement Company Ltd, MLCF and Kohat Cement, as they cumulatively contributed 109 points to the index, whereas The Hub Power Company, Bank Al Habib Ltd, Engro Polymer and Chemicals Ltd, Oil and Gas Development Company and Pakistan Petroleum Ltd lost value to weigh down on the index by 155 points.

Published in Dawn, October 24th, 2020