KARACHI: The State Bank of Pakistan (SBP) on Monday expressed complete satisfaction over the new estimate of 3.94 per cent GDP growth for FY21, noting that the rebound was fuelled by a well-calibrated policy response.

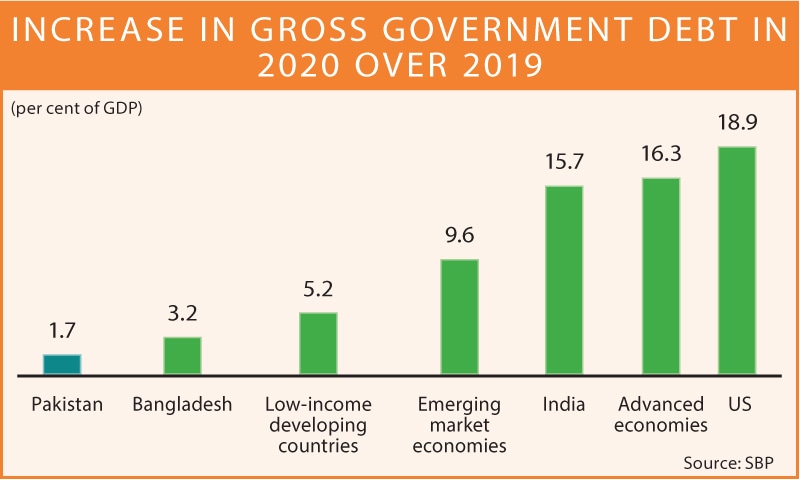

In a Twitter thread, the SBP said, “FY21 growth is expected to rise to 3.94pc, as post-Covid recovery underway since last summer has strengthened. The 9-mth current account is also in surplus for the 1st time in 17 yrs and FX reserves at a 4 yr high. This rebound was fueled by a well-calibrated policy response. Given high public debt, fiscal support was targeted to the most vulnerable, notably through the globally-acclaimed Ehsaas program. At the same time public debt and deficit were kept under check which has supported market sentiment, investment outlook, and economic recovery.”

“SBP provided a targeted economic stimulus of Rs2 trillion to support the recovery through interest rate cut, principal deferment & loan restructuring, Rozgar payroll finance scheme to prevent layoffs, and concessional finance for investment in industry and health facilities,” it added.

On May 22, the National Accounts Committee (NAC) released the estimate of 3.94pc GDP growth for FY21 which was higher than all the previous estimates of the SBP, International Monetary Fund and World Bank.

The SBP has come out with a statement in support of new high projection which is being doubted by both the political parties in opposition and some economists. However, the criticism has not been supported by any evidence against the estimate.

“The estimate released (by NAC) was approved unanimously and has the full backing of the SBP,” the central bank had said on May 22.

In the previous fiscal year (FY20), which was dominated by the Covid-19 pandemic, GDP growth was negative 0.47pc.

In FY21, the most supporting force is unexpected higher growth in wholesale and retail trade (within services sector) at 8.37pc.

Experts said the sector weight is 18.82pc in GDP and it contributes 40pc (or 1.58 percentage points) of FY21 growth.

The large-scale manufacturing (LSM) sector also witnessed an expected growth of 8.99pc during July-March FY21. The growth was negative with 5.1pc in FY20 during the same period.

“The provisional estimate for FY21 growth of 3.94pc reflects the strong economic recovery underway since the beginning of this fiscal year,” said the SBP.

The State Bank’s earlier estimate was 3pc against 1.5pc of IMF and 1.3pc predicted by the World Bank.

Published in Dawn, May 25th, 2021