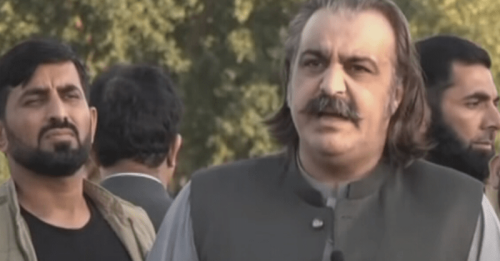

Prime Minister Imran Khan says the federal budget for 2021-22 is development-oriented and embodies a ray of hope for all segments of society.

Now the PTI government’s real challenge is to fulfil the nation’s hopes (feel-good sentiments) raised by the budget on the back of 3.94 per cent growth to regain its lost political capital. So one can expect more concerted efforts to improve the economy’s performance with the stipulation that its fruits are to be more widely distributed.

In any given state of governance, the success of a strategy, plan of action or programme is implicit in its effective implementation and that is where the real problem at the moment lies.

The policy focus on priority sectors/areas spelt out in the budget 2021-22 sets the direction towards achieving sustainable and inclusive growth. The sectors are housing and construction, small- and medium-sized enterprises (SMEs) manufacturing and CPEC-related industrialisation, all of which, in one way or another, are to be supported by stepped-up development spending or/and subsidised bank credit.

However, the substantial proposed increase in development spending for next year appears to be optimistic because of the existing slow pace of utilisation of allocated funds. The federal Public Sector Development Programme (PSDP) has been hiked to Rs900 billion for 2021-22 against the budgeted Rs650bn for this fiscal year. According to the finance ministry, the development spending amounted to Rs422bn as of June 3.

Now the PTI government’s real challenge is to fulfil the nation’s hopes raised by the budget on the back of 3.94 per cent growth to regain its lost political capital

But independent economists, according to an analyst, believe that even if 90pc of the budgeted development spending is utilised, it will not make a ‘qualitative difference’. They argue that “the delivery mechanism of PSDP is essentially the public sector, where the financial, administrative and planning-related inefficiencies lead to large over-runs on project costs and timelines. As a result, what gets spent has a lower economic and social contribution than originally anticipated.”

In the implementation phase when funds are diverted from slow-moving to fast-moving projects, priorities are distorted and an integrated approach required for socioeconomic development is discarded. Delays in the release of funds also result in cost overruns.

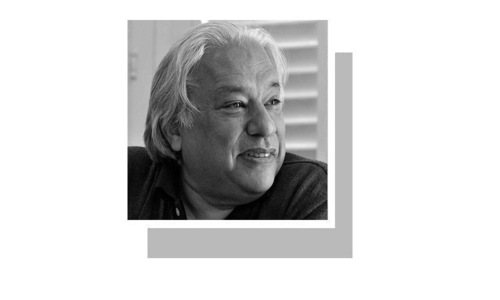

The most encouraging aspect of the budget, says Salim Raza, a member of the Economic Advisory Council, is the support measures for the bottom and middle of the economic pyramid. It seems to be a start, but a tangible infusion of finance at the country’s economic base could help ignite the broad-based growth missed for some decades now.

In the above context, the two sectors — SMEs and housing are of critical importance. Over the past two years, the incumbent government, with aggressive support from the central bank, has made tremendous efforts to boost the housing and construction industry. But the progress has fallen short of expectations. At best it is an initial start, and it appears to be a long-term issue. The International Monetary Fund has been approached to extend for another six months the amnesty scheme for the construction industry announced two years ago in April 2019. Earlier the last date was extended until June 30 from December 31, 2020.

About 3,851 buyers had shown interest in purchasing properties by availing tax incentives till May 6. Apart from the Rs30bn subsidy, Rs3bn have been provided for interest cost subsidy.

Doubts about building five million houses during the PTI-tenure of office persist. The rising cost of building materials, issues in availability, title and prices of urban land, the falling purchasing power of buyers of housing units and the cautious approach of the banks, in absence of foreclosure law, are stated to be impediments in the rapid growth of the sector.

Another long-neglected sector, SMEs, is a priority under the PTI government’s ‘bottom-up strategy.’ Here too the performance is primarily dependent on how the banks and financial institutions respond to the various incentives offered to SMEs by fiscal policies and subsidies on credit as much of the SME manufacturing is in the non-documented sector.

Apart from the interest-free loans, the budget provides SME flexibility to be taxed either on the bottom line profit at a maximum rate of 15pc or the gross amount of turnover at 0.5pc. SME is defined as an entity that is engaged in manufacturing and whose annual income does not exceed Rs250m. While PTI’s policy is likely to yield some positive results, any major turnaround in a limited span of time seems unlikely.

The stimulus provided to large scale manufacturing has helped the sector rebound quickly and production has surged on enhanced utilisation of existing capacity though there is still an output gap. Industrialisation, which could further boost production and employment in a more meaningful way with a focus both on setting up import substitution and export-oriented manufacturing units under China-Pakistan Economic Corridor (CPEC), is likely to gather steam only after the Special Economic Zones become functional with a one-window facility. Risks to growth from the rising current account deficit, estimated at $2.3bn or 1pc of GDP for next year, can be minimised by boosting and diversifying production, exports and import substitution.

Finance Minister Shaukat Tarin told the post-budget press conference that the government was committed to the fast-tracking implementation of CPEC. He informed newsmen that so far 17 projects worth Rs13bn were implemented, projects worth $21bn were underway while additional strategic projects of $28bn were in the pipeline.

The budget has allocated Rs7bn under PSDP for the development of Special Economic Zones (SEZ) under construction at Allama Iqbal Industrial City, Dhabeji, Rashakai and Bostan. But no date for completion of any one of these SEZs is yet known. In the case of industrialisation, the Chinese and other foreign companies have to be incentivised to set up factories while the current inflow of foreign direct investment is falling.

And representing the views of the business community as a whole, the All Pakistan Textile Mills Association says the budget is a step in the right direction subject to the implementation in letter and spirit of the budget proposals announced in the parliament.

Published in Dawn, The Business and Finance Weekly, June 21st, 2021

Dear visitor, the comments section is undergoing an overhaul and will return soon.