KARACHI: Stocks snapped the three-day winning streak on Friday after the KSE-100 index accumulated 808 points from 47,007 and crossed intraday the resistance of 48,000.

Profit booking by investors mainly in the power, banks, E&P, cement and investment banking sectors pulled back the index. Intraday the index oscillated between the high and low of 279 and 163 points.

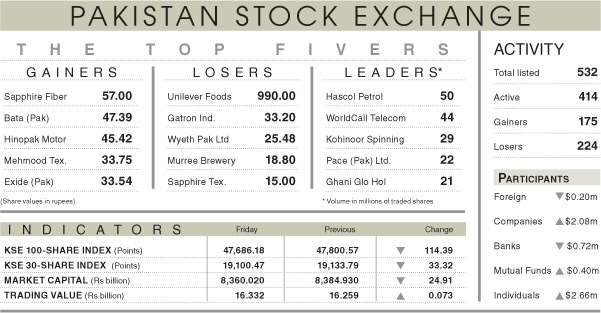

The benchmark concluded in the red to relinquish 114 points, or 0.24 per cent, at 47,686.

Head of Research at Spectrum Securities Abdul Azeem said that institutional buying in blue-chips could help index renew its climb. He said that activity was mainly concentrated in side-board items.

The figures released by the National Clearing Company of Pakistan showed that insurance companies were major sellers of stocks worth $4.33m.

Companies and individuals supported the index by mopping up excess liquidity. The investors’ nervousness was evident at close to the 48,000 level aside; they also waited for fresh triggers. The higher than expected CPI inflation and wider trade deficit were already the negative news.

Foreign investors did not dash for the door despite the downgrade of MSCI Pakistan to Frontier Market (FM) from Emerging Market (EM).

Analysts at Arif Habib Ltd said that regardless of the stable oil prices in the international market and an overnight jump therein, listed E&P sector stocks remained bearish with selling pressure in OGDC and PPL.

Besides the two E&P shares other laggards for the day were Hub Power; PPL, Cherat Cement; Hascol and MCB Bank. On the flip side, shares that provided support to the index included Lucky Cement, AGP, TRG, Kohat Cement; Fauji Fertiliser, Exide and a couple of shares on the automobile sector that contributed positively to the index.

The trading vlume declined 26pc over the previous session to 563.8mn shares with Hascol and WorldCall being to contributors. The traded value for the day stood at $103.5m which represented a nominal increase of 0.4pc over the previous day.

Published in Dawn, July 3rd, 2021