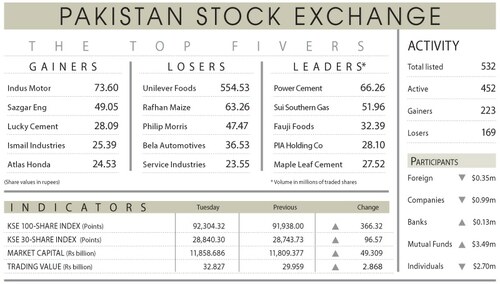

KARACHI: Extending its winning streak for the second day, the KSE-100 index spiralled upwards by 305 points, or 0.64 per cent, to close at 47,758 on Tuesday.

In the first two days of the week, the benchmark index recouped 700 points slightly short of the 738 points that were lost in all of the previous week. Intraday the index surged by 355 points.

Investors were able to overcome the fear of the raging fire of Covid as the vaccination had taken off in full swing while the Sindh government appeared to quietly ease some of the restrictions. Investors also drew comfort from the federal government’s opposition to complete lockdown.

The heavy rupee depreciation was seen as a blessing for the textile, technology & E&P sectors where healthy growth income was anticipated. As the results season had just started investors were willing to bet on higher dividends from major corporates.

Traders remained focused on positive news flow including higher exports, remittances and revenue collection and improvement in trade deficit for July by $590m nonth-on-month. OCAC published its monthly data where overall volumetric sales of petroleum products increased 16pc year-on-year in July to 1.94 million tonnes. Moreover, the approval by the IMF board of governors for the $650bn SDR allocation paves way for Pakistan to receive $2.8bn.

As institutions jumped into the fray on concerns of being left, the trading volume shot up 75pc over the previous day to 443m shares. Among scrips, WorldCall topped the list with 36m shares changing hands. Aggregate value of shares traded also surged 75pc to Rs16.2bn.

Among sectors, cements came out of hibernation and stood out as the lead contributors to the index of 64 points on reports of price increase per bag. Technology sector followed with addition of 63 points, banks 55 points, O&GMCs 42 points and refinery 26 points. Exploration & Production and the steel sectors remained under selling pressure. Major gainers for the day were TRG, HBL, MEBL, MLCF and POL.

Published in Dawn, August 4th, 2021

Dear visitor, the comments section is undergoing an overhaul and will return soon.