KARACHI: Bulls chased the bears out of the stock market in the outgoing week with the KSE-100 index rebounding by 435 points, or 0.9 per cent.

Regardless of repeated attempts, the index did not manage to cross the 48,000 level at closing and settled at the end of the last session at 47,490.

After two faltering weeks that saw a loss of over 600 points, the rally at the market was triggered by the disapproval of the federal government to the complete lockdown clamped by the Sindh government.

Although there was no respite in new Covid cases and a worrying surge in positivity and death ratios, investors were relieved as the fear of closure of business and industrial activities was dispelled.

Moreover, the shrinkage of trade deficit by 16pc month-on-month for July, the expectations of $2.8bn SDR allocation from the IMF that would go to consolidate the foreign exchange reserves and the start of the result season encouraged investors to accumulate dividend-paying, growth stocks.

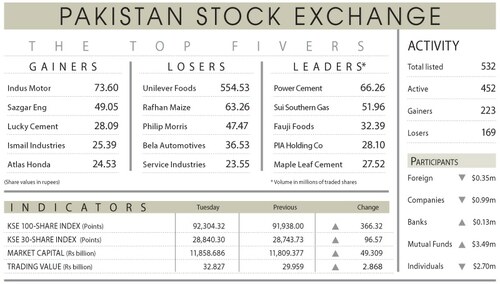

Foreign investors fortified their portfolios with stocks worth $3.1m. Buying was witnessed in technology ($1.8m), cements ($1.3m) and OMCs ($0.2m). Among local participants, individuals stood out as the major buyers of equity valued at $7.6m.

Mutual funds sold securities worth $10.5m ostensibly to meet redemptions while insurance companies offloaded stocks worth $6.1m.

Average daily trading volume clocked-in at 455m shares which represented an increase of 12pc week-on-week and came up as the highest in the past four weeks. The trading value settled 5pc down at $85m.

Sector-wise positive contributions came from commercial banks (193 points), oil & gas marketing companies (52 points), and chemical (52 points).

Meanwhile, the sectors that contributed negatively majorly include food & personal care (21 points) and tobacco (7 points). Scrip-wise positive contributors to the index were mainly MEBL (84 points), MCB Bank (43 points) and HBL (41 points). Whereas, scrip-wise negative contribution came from Lucky Cement (41 points), PSEL (36 points), and Unity Foods (19 points).

Going forward, the Covid fourth wave would be the key factor that would determine the direction of the market. Fears were mounting by the close of the outgoing week on soaring infection cases, growing death numbers and the positivity ratio that crossed the 9pc, setting off panic buttons in both the central and provincial governments.

Both are contemplating measures to combat the virus. Other than that, the concerns remain on hike in inflation due to expected increase in petroleum prices.

Key announcements next week include the release of auto sales numbers for July, and auction results for MTBs and PIBs (floating rate).

The low interest rate and pro-growth stance of the SBP should keep stocks attractive.

The redeeming feature that could keep investors interest alive would be the result season which would pick up pace with several heavyweights such as Lucky Cement, EPCL, MCB, Attock Group companies, MEBL, and MLCF coming up with their numbers.

Published in Dawn, August 8th, 2021

Dear visitor, the comments section is undergoing an overhaul and will return soon.