ISLAMABAD: In a bid to eliminate tax evasion in key sectors of the economy, the Federal Board of Revenue (FBR) has initiated consultations to implement the Track & Trace System (TTS) in production units. The first meeting in this regard will be held at the FBR headquarters on Monday (tomorrow).

The FBR has invited representatives of five sugar mills for consultations on the TTS along with the Pakistan Sugar Mills Association (PSMA).

However, the sugar industry has already expressed reservations over the move and claimed that pasting of TTS sticker stamps on sugar bags would not be feasible as these will come off and eventually benefit tax evaders.

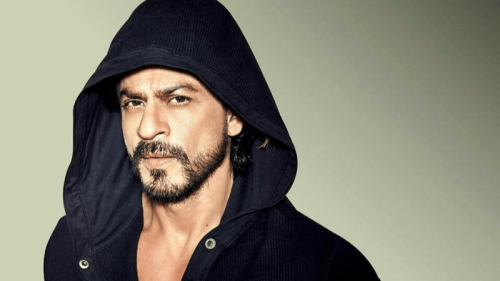

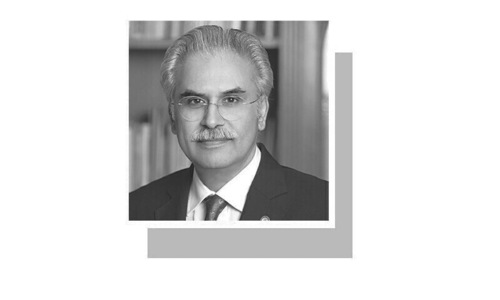

Soon after becoming the chairman of FBR, Muhammad Ashfaq Ahmed had initiated the process of implementing TTS in tobacco, cement, sugar and fertiliser sectors.

However, the sugar industry has opposed the move, claiming that the new technology could not be applied to the polypropylene bags as the stickers will not stick to them.

In a letter addressed to Prime Minister Imran Khan, the Pakistan Polypropylene Woven Sack Manufactures Association (PPWSMA) sought support against the implementation of TTS and instead urged for printing the Quick Response (QR) code at the bags.

In the letter, PPWSMA Chairman Iskendar Khan, who is also the chairman of PSMA, said, “We have requested the FBR to place a mandatory requirement for all the polypropylene factories to print QR codes on bags produced for sugar, fertiliser, cement, wheat flour, wheat, pulses, rice and animal feed etc.”

The installed QR code machine will be connected with a computer system having software to generate sales invoice showing price and quantum of sales tax which is documented in the QR code be verifiable/readable via mobile phone application enabling the FBR to trace back each and every polypropylene bag produced for industrial packaging.

Published in Dawn, August 29th, 2021