ISLAMABAD: The government on Friday decided to involve commercial banks and microfinance banks through bidding in its flagship Kamyab Pakistan Programme (KPP) that has been scaled down to address concerns of the International Monetary Fund (IMF).

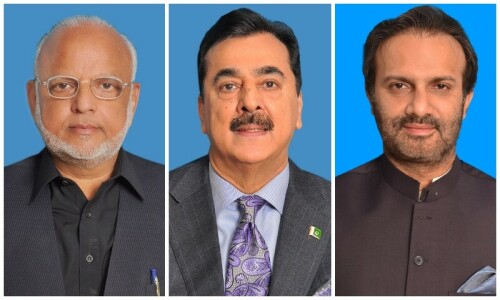

The decision was taken at a joint meeting of the Steering Committee and Advisory Board of KPP presided over Minister for Finance Shaukat Tarin. During the meeting, the programme design was reviewed and contours of KPP were finalised in consultation with the relevant stakeholders.

After extensive discussion, “it was decided that a robust bidding process will be undertaken for selection of wholesale lenders (banks) who in turn will exclusively engage with executing agencies (microfinance providers)”, said a statement issued by the Ministry of Finance.

KPP scaled down to address IMF’s concerns over its fiscal sustainability

There will be a quarterly performance review of wholesale lenders with reference to disbursement of funds. The government will extend guarantee to wholesale banks of up to 50 per cent on a risk sharing basis. “This will ensure transparency and due diligence in evaluating the performance of wholesale lenders with reference to disbursement of funds,” the ministry said.

Early this week, the finance minister had said the government would launch within this year a trimmed down KPP to support four-six million households. He said the IMF had agreed to the revised KPP as it was neither a politicised project nor involved any risks.

The size of the programme for first year has been reduced to about Rs156 billion from originally envisaged Rs315bn, while the chunk of subsidy has also been reduced from Rs21bn to Rs10-12bn.

The programme will be operated through a KPP portal called Kamyab Pakistan Information System (KPIS). There will be a toll-free number which will be integrating KPIS through telecoms via the National Telecom Communication.

The portal will be integrated with Ehsaas Data and the National Database and Registration Authority for verification of beneficiaries’ eligibility to facilitate the executing agencies (microfinance providers) for finalising financing modalities in an efficient and seamless manner.

The finance minister said the programme was designed to transform the lives of the marginalised segments of society and ensure their financial empowerment, adding that utmost care was being taken before the launch of KPP to ensure that all stakeholders were on board for ultimate success of the programme.

The programme will be launched in phases to cover all areas of the country effectively. During the first phase, Khyber Pakhtunkhwa, Baluchistan and the poorest of the poor districts of Punjab, Sindh, Gilgit-Baltistan and Azad Kashmir will be covered. The revised proposal will be submitted to the Economic Coordination Committee for deliberation and requisite examination before its formal approval by the federal cabinet.

The programme was initially prepared for three years with a combination of a series of schemes, mostly targeting the lower-middle income population, and involved about Rs253bn of direct subsidy from the budget in three years.

The IMF had, however, raised concerns over its fiscal sustainability while some quarters within the government had certain fiduciary concerns and wanted to be protected against regulatory actions or competitive bidding to induct lending partners for mark-up. The IMF’s concern over 100pc loan guarantee has now been addressed by reducing it to 50pc.

The meeting was attended, among others, by Special Assistant to the Prime Minister on Youth Affairs Usman Dar, State Bank of Pakistan Deputy Governor Sima Kamil, Securities and Exchange Commission of Pakistan Chairman Aamir Khan, KPP convener Zafar Masud and Pakistan Banks Association Chairman Muhammad Aurangzeb.

Published in Dawn, September 18th, 2021