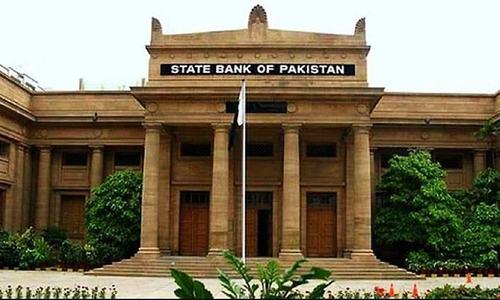

KARACHI: The government expects higher economic growth in the current fiscal year (FY22) though the private sector seems to have slowed down its activities as reflected from its bank borrowing and debt retirement, the State Bank of Pakistan (SBP) reported for the current week.

The private sector — which is the backbone of the economy — has been retiring debts for the last two months instead of making fresh borrowings. The debt retired during July-Aug FY22 was Rs145.7 billion.

The economic growth rate increased in the last quarter of the previous fiscal and the government announced growth rate as 3.9 per cent against the earlier estimated growth rate of about 2pc.

Since the last quarter showed strong growth, it was expected that FY22 would exhibit the same pace it witnessed just before end of the previous fiscal FY21.

However, the latest SBP data showed that the private sector’s activities have dropped. During July-Aug FY21, the private sector retired an amount of Rs157bn. This retirement of debts reflected slow movement in the economy which had started taking speed in the second half of the previous fiscal; the pace of growth could not be carried on.

The total amount borrowed by the private sector from banks in FY21 was Rs766.2bn against Rs196bn in the preceding year. The borrowing in FY21 was very high, reflecting the higher economic activities but the beginning of FY22 does not match with the pace of borrowing noted in the second half of FY21.

The data presented some interesting figures. Islamic banking continued to provide credit to private sector while net retirement of debts was noted in the balance sheet of conventional banks.

The conventional banks are the largest source of money for the businesses in Pakistan. During the first two months of the current fiscal year it noted a net retirement of Rs170.8bn. In FY21, Rs379.6bn was provided by the conventional banks to the private sector.

During the first two months of FY22, the credit off-take by the private sector from Islamic banking branches of conventional banks were Rs17.9bn against just Rs321 million in the same period of last fiscal year. During the entire FY21, credit off take from this Islamic branches were Rs224.4bn

The credit offtake by the private sector from Islamic banks was also positive with a net supply of Rs7.2bn during the two months of FY22. The Islamic banks provided total Rs162bn in FY21 to the private sector.

The trend shows that Islamic banking is becoming more attractive for businesses in the country and has started occupying a larger place in the banking industry.

Published in Dawn, September 19th, 2021

Dear visitor, the comments section is undergoing an overhaul and will return soon.