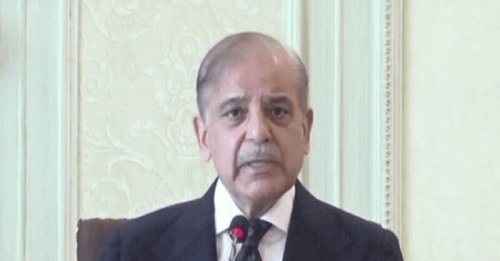

KARACHI: State Bank of Pakistan (SBP) Governor Dr Reza Baqir said on Friday the central bank is determined to “take any and all measures” to ensure that economic growth remains sustainable.

Addressing the Pakistan Banking Awards (PBA) 2021 ceremony, Dr Baqir said the country will announce the agreement with the International Monetary Fund (IMF) “very soon” for the next review.

“We see the journey ahead in partnership with the IMF. It’s not just the money that the IMF gives. It’s also the fact that we have confidence in the direction of our policies. Therefore, we’re very happy that an independent international institution gives to the rest of the world... its assessment of the outlook,” he said.

In his 45-minute address to bank CEOs and senior management, Dr Baqir spoke at length about sustainable economic growth without mentioning belt-tightening or austerity that people generally expect under an IMF loan programme.

HBL wins best bank award

“Today, we have a very welcome challenge, the challenge of growth. It’s a challenge that we’ve been wanting to have. For the last two years, growth has been slowing. The fact that we’re expected to grow close to five per cent this year is a welcome challenge for us,” he said.

The SBP governor said the current growth phase is going to be sustainable because, unlike previous growth spurts, it’s supported by a market-based exchange rate system.

“One factor that’s supporting and ensuring that our growth will be sustainable is our market-based exchange rate system. Since its introduction in June 2019, it’s played a very helpful role of a shock absorber,” he said, noting that it’ll ensure that the current account deficit doesn’t grow too much.

He listed many SBP initiatives — like concessionary finance schemes for exporters, higher remittances and Roshan Digital Accounts — that’ll help increase the supply of foreign exchange in the market, thus reducing the pressure on the rupee.

“The market-based exchange rate system is going to ensure that our external position remains sustainable,” he said.

Meanwhile, Habib Bank Ltd received the PBA award for the best bank. It also received the prize for the best bank for small and medium businesses.

The award for the best microfinance award went to Khushhali Microfinance Bank Ltd. National Bank of Pakistan was acknowledged as the best bank for agriculture. United Bank Ltd grabbed the award for the best digital banking.

The prize for the best customer franchise went to Bank Alfalah. Pakistan Microfinance Investment Company was the winner in the category of the best contribution by a non-bank entity.

The jury didn’t announce any winners in the best emerging banking and the most innovative business categories.

Institute of Bankers Pakistan holds the annual awards in partnership with the Dawn media group and in collaboration with A.F. Ferguson and Company.

Published in Dawn, October 30th, 2021