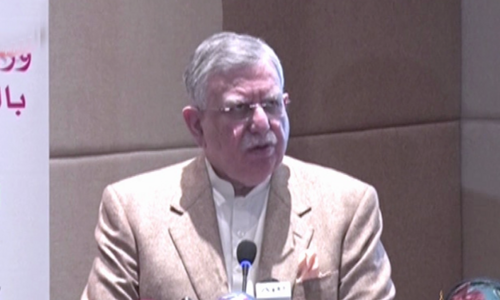

KARACHI: Adviser to the Prime Minister on Finance and Revenue Shaukat Tarin has assured land developers that the federal government will extend the exemption on wealth reconciliation statement for first-time home buyers beyond Dec 31.

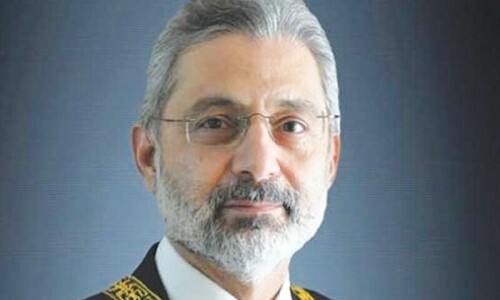

Speaking at the groundbreaking ceremony of Naya Nazimabad Hospital on Sunday, Mr Tarin said it’s “everyone’s right to receive a tax break” when they purchase their first home. “We’ll definitely consider it,” he said after real estate developer Arif Habib demanded in his address that the exemption be extended for first-time home purchases of less than Rs50 million.

Mr Habib acquired Javedan Corporation, a cement factory on the outskirts of Karachi, when it was privatised in 2006 and turned its 1,300 acres of land into a housing project under the name of Naya Nazimabad.

“I won’t ask you to waive the requirement of a wealth reconciliation statement for developers when they buy land for housing projects. They’ve already benefited from quite a few amnesties. But please continue the fixed tax regime and wealth reconciliation exemption for first-time home buyers beyond 2021,” he said, noting that most developers are now getting their payments from allotees through cheques instead of cash.

Mr Habib drew the attention of the finance adviser to the unusually low valuation of shares listed on the Pakistan Stock Exchange (PSX) despite the fact that the national bourse has yielded the “highest returns in dollar-adjusted terms” among all regional economies, including China, for the last 15 years.

“The KSE-100 index is currently trading at (2022) forward price-to-earnings (P/E) multiple of 4.9 versus the historical average of 8.1,” he said while referring to the indicator that measures a company’s share price relative to its earnings. A low P/E multiple means shares are available at a discount.

Given the average P/E multiple of 14.8 in nine peer economies, listed companies in Pakistan are up for grabs at a discount of 67 per cent, he said. In terms of the dividend yield, a measure that shows dividend as a percentage of the current share price, Pakistani stocks are selling at a discount of 73pc compared with the same peer economies, he added.

He also lamented the persistent selling of shares by foreign investors. Currently, foreigners hold shares worth $2.3 billion on the PSX, which is 18pc of the free float or publicly traded shares. In contrast, their holdings amounted to $8.8bn or 33pc of the free float just five years ago, he added.

He urged Mr Tarin to restore confidence in investors as public-sector companies, especially in the energy value chain, continue to face liquidity issues because of the circular debt.

Responding to Mr Habib’s comments, the finance adviser said energy heavyweights should announce dividends and count the same towards settling the circular debt. The government owns major stakes in big energy companies and will directly benefit if they announce dividends. “I don’t want your cash,” he said, noting that the move will increase their valuations on the stock market and also bring down the circular debt by Rs300-400bn.

“When valuations go up, we can also do GDRs,” he said while referring to global depositary receipts, an instrument to raise capital by listing local companies on foreign stock exchanges.

Published in Dawn, November 16th, 2021