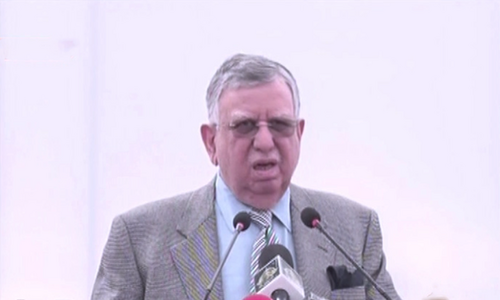

ISLAMABAD: Adviser to the Prime Minister on Finance Shaukat Tarin has said Pakistan will have to complete about five “prior actions” before the International Monetary Fund (IMF) calls a meeting of its board of directors to approve revival of its $6 billion Extended Fund Facility suspended in April this year.

Talking to journalists at the launch of Corporate Philanthropy Survey here on Tuesday, Mr Tarin said all issues with the IMF staff had been settled on the basis of which they gave “us a list of five prior actions” to complete so that they could call a board meeting on Pakistan’s case. “Don’t ask me [about] dates but IMF deal is done,” he added.

Mr Tarin said these prior actions included State Bank of Pakistan (Amendment) Bill, withdrawal of tax exemptions and increase in energy tariff. He said the action pertaining to tariff adjustment had already been met for now with a recent Rs1.39 per unit increase while bills to end tax exemptions and give autonomy to the SBP had been prepared. The next tariff increase would take place by February-March 2022.

Actions include SBP bill approval, withdrawal of tax exemptions, increase in energy tariff

The finance adviser said the two bills were being fine-tuned for finalisation by the Ministry of Law and Justice after the two sides completed discussions. When pointed out that the IMF board may meet on December 17 as earlier scheduled and then delayed until February, he explained that the IMF board could be called anytime provided prior actions were complete.

Sources said Mr Tarin had also asked the public sector entities involved in circular debt to announce dividends based on receivables on their accounts. The government will divert its dividend share to clear payables. This will reduce circular debt by over Rs200bn and clear balance sheets of the entities on the basis of which the government will raise global depository receipts (GDRs) in the international market.

The sources said Mr Tarin had been able to convince the IMF staff to significantly alter the SBP amendment bill that former finance minister Dr Hafeez Shaikh and SBP Governor Dr Reza Baqir had committed to the IMF ahead of $500 million disbursements in March this year.

The sources said the IMF wanted Rs170bn worth of tax exemptions in addition to improved petroleum levy collections for which the government had set Rs610bn target for the year but could collect about Rs50bn in the first four months. The saving grace on this front was revenue collection that was significantly higher than the target.

But there are still certain things which cannot be changed given the disbursement of $500m is approved by the IMF board on the basis of those commitments. Also, the IMF is no more ready to accept ordinances as prior action for removal of tax exemptions and unprecedented powers and protections to the SBP management and has now linked approval of the bills by parliament as prior actions.

Responding to a question about prior actions required from the central bank, Mr Tarin said the monetary policy and exchange rate were the domain of the SBP and the monetary policy committee and he would neither like to interfere nor comment.

In reply to another question, he said the shifting of various accounts of a number of federal and provincial government entities worth trillions of rupees into a single treasury account was also a condition of the IMF programme, but this was not a prior action and would be gradually complied with. It is now a matter of record that those at the helm of economic affairs at the time had pushed through the SBP law that is now being seen in violation of the Constitution.

The central bank management had tried to secure complete autonomy for its acts of omissions and commissions without any accountability. The initial draft amendment law shared by the IMF and reconciled by the Ministry of Finance and the central bank was still under vetting of the Law Division and the Cabinet Committee on Disposal of Legislative Cases (CCLC) when a new draft reached the cabinet seeking exemption from mandatory review by the CCLC in rush.

The cabinet granted the exemption from CCLC review and, without a detailed presentation or discussions, also cleared the controversial bill on the premise that it would strengthen institutions and was unavoidable to secure revival of the IMF programme and disbursement of $500m.

The criticism that followed compelled the government to realise why the CCLC review had been bypassed and hence decided to backtrack.

The unmet condition has now become a ‘prior action’ that the said bill should be passed by parliament to qualify the government to draw another billion dollars with the approval of the IMF board.

Shaukat Tarin and Law Minister Farogh Naseem had explained to the IMF staff that not only such legislation was ultra vires of the Constitution, but the time required for the legislation was also insufficient given the processes involved.

Published in Dawn, November 17th, 2021