KARACHI: The benchmark index of the Pakistan Stock Exchange remained mostly in the green zone on Friday as investors hailed growth in the large-scale manufacturing sector, which expanded 5.15 per cent in July-September on an annual basis.

According to Arif Habib Ltd, the second half saw profit-booking following the announcement of a current account deficit of $1.7 billion in October mainly on the back of a 66pc rise in imports. On the institutional front, accumulation was witnessed in the stocks of the banking sector.

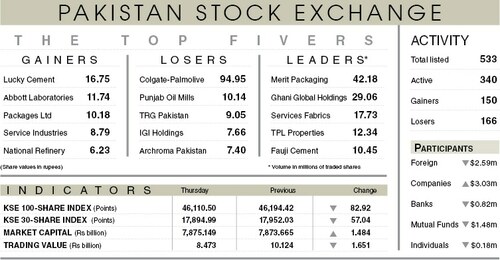

As a result, the KSE-100 index gained 378.91 points or 0.82pc to close at 46,489.41 points.

Market participation increased 15.4pc to 304.21 million shares while the value of traded shares increased 41.6pc to Rs11.99bn.

Sectors contributing the highest number of points to the benchmark index included commercial banking (178.96 points), fertiliser (102.23 points), oil and gas exploration (67.99 points), cement (62.03 points) and textile (25.2 points).

Stocks that contributed significantly to the traded volume included Ghani Global Holdings Ltd (33.89m shares), Service Fabrics Ltd (17.86m shares), First National Equities Ltd (14.85m shares), Fauji Foods Ltd (10.57m shares) and WorldCall Telecom Ltd (10.42m shares).

Stocks that contributed positively to the index included Engro Corporation Ltd (62.03 points), MCB Bank Ltd (38.94 points), Lucky Cement Ltd (38.83 points), Pakistan Petroleum Ltd (37.26 points) and Habib Bank Ltd (36.91 points).

Shares that contributed negatively included TRG Pakistan Ltd (93.88 points), Systems Ltd (20.22 points), The Hub Power Company Ltd (20.01 points), Habib Metropolitan Bank Ltd (7.87 points) and Pakistan Stock Exchange Ltd (4.65 points).

Stocks recording the biggest increases in percentage terms included Fatima Fertiliser Company Ltd, which went up 7.48pc, followed by Azgard Nine Ltd (6.36pc), Kohinoor Textile Mills Ltd (4.32pc), Adamjee Insurance Ltd (4.27pc) and Colgate-Palmolive Pakistan Ltd (3.95pc).

“The monetary policy committee’s decision to raise the policy rate by 150 basis points to 8.75pc will create volatility in the upcoming rollover week,” said the research note by Arif Habib Ltd.

Published in Dawn, November 20th, 2021

Dear visitor, the comments section is undergoing an overhaul and will return soon.