KARACHI: A higher-than-expected increase in the benchmark interest rate by the State Bank of Pakistan unnerved stock investors on the first day of the rollover week.

According to Arif Habib Ltd, bearish sentiments dominated trading despite the long-awaited news of Pakistan and the International Monetary Fund (IMF) reaching a staff-level agreement.

“Firstly, only cyclical stocks came under the radar and investors started offloading positions. Later on, a bloodbath session was witnessed with across-the-board selling,” it added.

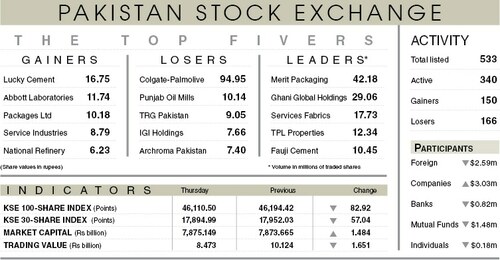

As a result, the KSE-100 index lost 744.41 points or 1.6 per cent to close at 45,745 points.

Market participation decreased 13.9pc to 261.9 million shares while the value of traded shares dropped 8.8pc to $62.6m.

Sectors taking away the highest number of points from the benchmark index included cement (184.02 points), technology and communication (153.04 points), oil and gas exploration (89.78 points), fertiliser (69.74 points) and textile (37.55 points).

Stocks that contributed significantly to the traded volume included TRG Pakistan Ltd (22.37m shares), Byco Petroleum Ltd (21.6m shares), TPL Properties Ltd (15.81m shares), Treet Corporation Ltd (13.53m shares) and G3 Technologies Ltd (11.73m shares).

Stocks that contributed positively to the index included Meezan Bank Ltd (36.61 points), Bank AL Habib Ltd (13.63 points), United Bank Ltd (12.44 points), Bank Alfalah Ltd (3.91 points) and Atlas Honda Ltd (1.86 points).

Shares that contributed negatively included Lucky Cement Ltd (96.01 points), TRG Pakistan Ltd (86.81 points), Systems Ltd (56.45 points), Engro Corporation Ltd (38.72 points) and MCB Pakistan Ltd (38.03 points).

Stocks recording the biggest declines in percentage terms included TRG Pakistan Ltd, which went down 7.5pc, followed by Azgard Nine Ltd (6.86pc), Aisha Steel Mills Ltd (6.19pc), Pioneer Cement Ltd (5.18pc) and Yousaf Weaving Mills Ltd (4.92pc).

According to JS Global, the realisation of the IMF loan tranche along with the Saudi assistance package is expected to provide a reason for the stock market to rebound going forward.

Published in Dawn, November 23rd, 2021