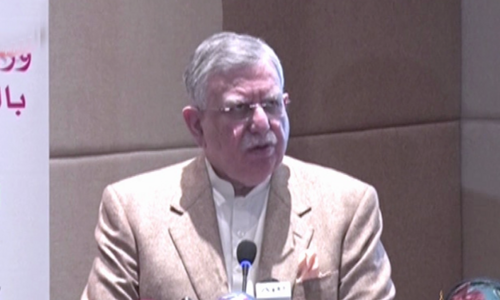

Adviser to the Prime Minister on Finance and Revenue Shaukat Tarin on Friday assured that the government would not increase taxes in the supplementary budget it plans to introduce in the National Assembly following the agreement with the International Monetary Fund (IMF) earlier this week.

However, certain exemptions will be withdrawn, he shared while talking to the media in Karachi.

When a reporter asked the adviser to comment on the mini-budget, Tarin remarked that it seemed the reporter wanted to create sensationalism. "Taxes will not increase. Certain exemptions will be withdrawn.

"In March, the government had signed for [removal of] Rs700bn in exemptions and [imposition] of new taxes, after which it got $500 million," he recalled.

He was referring to the release of $500m by the IMF in March after approving four pending reviews of the country's economic progress following the government's decision to implement the withdrawal of corporate tax exemptions and put in place a mechanism for automatic electricity power tariff increases.

"When I came [as finance minister], I had said we will not allow an increase in taxes. We will not allow [the IMF] to impose more taxes on people who are already paying them."

The adviser said his ministry had stood firm on its stance of not increasing taxes during negotiations with the IMF.

Tarin said the IMF questioned why Pakistan had distorted its tax system, adding that the Fund's argument held substance. "They say, 'you have imposed 17 per cent sales tax on some [sectors], zero on some and 10pc on some. Take your sales tax and give them targeted subsidies [instead]'."

Talking about the fertiliser industry, the adviser said the government provided subsidised gas to companies as well as did not impose any tax. The combined subsidy provided to the fertiliser industry was around Rs150 billion, he said, questioning: "Is this reaching our farmers?"

The government will use the Ehsaas database to provide direct subsidy to farmers instead, he said.

'Rupee to move on both sides'

The adviser criticised people who were making speculations about the exchange rate.

"First it was said that [rupee] was falling because the deal with IMF was not reached. The agreement happened [...] The benchmark is the real effective exchange rate. It compares your currency to the currency of your competitors and says your exchange rate should be around [the specific figure]. Experts say that according to the real effective exchange rate, the rupee should [be traded] around 165 or 167 or 168," he explained.

He refuted rumours that the rupee will be demonetised, stressing that the government will not take any steps that will affect businesses' confidence or create distortion in the market.

"We are taking some steps because of which the rupee will go on the other side. They (speculators) will be badly defeated so don't get into this kind of speculation. Rupee will move on both sides," he said.

Agreement with IMF

On Monday, the IMF had announced that it had reached an agreement with Pakistan on policies and reforms needed to complete the sixth review under the $6bn Extended Fund Facility (EFF) which has been 'in recess' since April.

The agreement is subject to approval by the Fund's Executive Board, following the implementation of prior actions, notably on fiscal and institutional reforms, the IMF said. The approval of the agreement will make available 750m in Special Drawing Rights (SDR), equivalent to $1,059m, it added.

The SDR is a basket of mixed currencies made available to member countries of the IMF.

In a press conference on the same day, Tarin had made an announcement about 'five prior actions' that were needed to secure approval of the IMF board. Those actions include introducing a supplemetary budget for a net fiscal adjustment of almost Rs550bn during the remaining part of the current fiscal year through a 22pc cut in development funds, about Rs300bn increase in tax target and a Rs4 per litre monthly hike in petroleum levy on major petroleum products.

Tarin said the government would also ensure "approval" of parliament to grant autonomy on matters of monetary policy, exchange rate and recruitments to the State Bank of Pakistan (SBP) that would remain answerable to parliament as it is now.