KARACHI: Stock investors welcomed on Friday the injection of liquidity by the central bank into the money market — a move that is expected to restore stability in short-term interest rates.

Initial volatility on the Pakistan Stock Exchange turned into a bullish run in cement and steel sectors as soon as investors learned about the central bank’s open market operation to stabilise the money market, according to Arif Habib Ltd.

Trading activity continued to remain sideways, however, as the market witnessed hefty volumes in third-tier stocks.

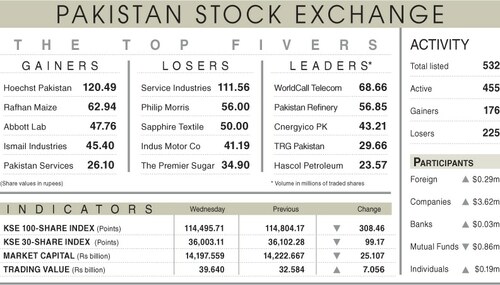

As a result, the KSE-100 index added 169.48 points or 0.39 per cent to close at 43,900.68 points.

Market participation decreased 19.2pc to 252.2 million shares while the value of traded shares also went down 20.4pc to $45.2m.

Sectors contributing the highest number of points to the benchmark index included cement (69.77 points), commercial banking (60.37 points), oil and gas exploration (34.87 points), engineering (27.67 points) and technology and communication (27.65 points).

Stocks that contributed significantly to the traded volume included WorldCall Telecom Ltd (29.21m shares), Hum Network Ltd (25.96m shares), TeleCard Ltd (17.47m shares), TRG Pakistan Ltd (14.43m shares) and Byco Petroleum Ltd (11.58m shares).

Shares contributing positively to the index were Systems Ltd (47.98 points), Habib Bank Ltd (42.41 points), Lucky Cement Ltd (27.44 points), Pakistan Petroleum Ltd (20.33 points) and Oil and Gas Development Company Ltd (14.36 points).

Stocks that took away the maximum number of points from the index included Colgate-Palmolive Pakistan Ltd (24.61 points), TRG Pakistan Ltd (15.59 points), Engro Corporation Ltd (9.97 points), Meezan Bank Ltd (7.87 points) and Fauji Fertiliser Company Ltd (6.94 points).

Stocks recording the biggest increases in percentage terms included Yousaf Weaving Mills Ltd, which went up 6.77pc, followed by Aisha Steel Mills Ltd (5.56pc), Bannu Woollen Mills Ltd (5.07pc), International Steels Ltd (5.01pc) and HBL Growth Fund (4.41pc).

Foreign investors remained net sellers as they offloaded shares worth $2.33m on a net basis.

Published in Dawn, December 18th, 2021

Dear visitor, the comments section is undergoing an overhaul and will return soon.