KARACHI: The KSE-100 index stayed in the positive zone on Friday as the benchmark closed the last trading session of 2021 at 44,596.07, up two per cent in rupee terms from a year ago.

The Dec 31 trading session concluded another year with dismal stock returns that were significantly lower than the 30-year annualised rate of 12pc, according to Topline Securities.

The index is 16pc lower than its May 2017 peak of around 53,000 while market capitalisation is down 14pc in a year in dollar terms. It’s only $43 billion now as opposed to the all-time high of $100bn in May 2017, the brokerage said.

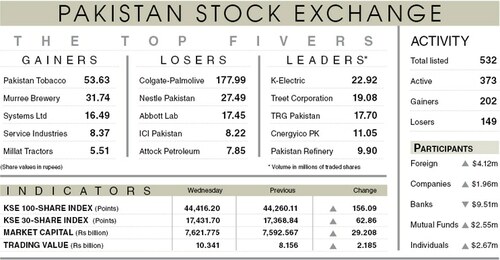

The KSE-100 index gained 179.87 points or 0.4pc on Friday to close at 44,596.07 points.

Market participation increased 30.67pc to 317.64 million shares while the value of traded shares went up 4.71pc to Rs10.82bn.

Sectors contributing the highest number of points to the benchmark index included oil and gas exploration (73.33 points), commercial banking (64.13 points), fertiliser (49.54 points), cement (35.94 points) and food and personal care (22.56 points).

Stocks that contributed significantly to the traded volume included WorldCall Telecom Ltd (41.96m shares), Cnergyico PK Ltd (39.83m shares), TRG Pakistan Ltd (20.43m shares), Pakistan Refinery Ltd (19.78m shares) and K-Electric Ltd (13.12m shares).

Shares contributing positively to the index were Habib Bank Ltd (31.42 points), Fauji Fertiliser Company Ltd (29.81 points), Pakistan Oilfields Ltd (24.19 points), MCB Bank Ltd (21.69 points) and Oil and Gas Development Company Ltd (19.68 points).

Stocks that took away the maximum number of points from the index included TRG Pakistan Ltd (79.78 points), Meezan Bank Ltd (24.12 points), Systems Ltd (14.92 points), Dawood Hercules Corporation Ltd (10.36 points) and Avanceon Ltd (5.66 points).

Stocks recording the biggest increases in percentage terms included Nestle Pakistan Ltd, which went up 5.59pc, followed by Standard Chartered Bank Pakistan Ltd (4.53pc), Maple Leaf Cement Factory Ltd (3.78pc), Aisha Steel Mills Ltd (3.58pc) and Pakistan Telecommunication Company Ltd (3.57pc).

Published in Dawn, January 1st, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.