KARACHI: Trading on the stock exchange closed in the green zone on Monday after the trade deficit figure declined to $4.1 billion for December.

According to Arif Habib Ltd, a recovery in the rupee against the dollar during the last week also helped the benchmark index end higher on a day-on-day basis. The stock market opened with a low volume but a rally in the cement sector kicked in on the back of a drop in international coal prices for the third consecutive session.

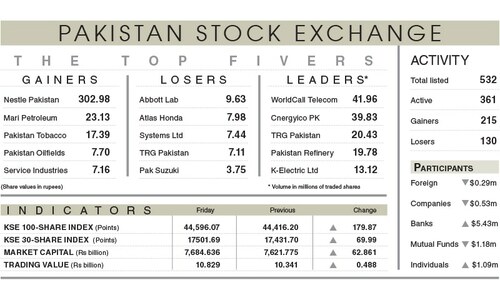

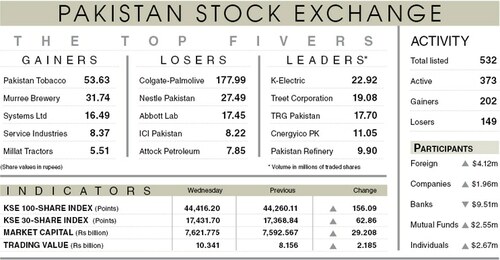

As a result, the KSE-100 index gained 290.82 points or 0.65 per cent on Monday to close at 44,886.89 points.

Market participation decreased 38.6pc to 195.2 million shares while the value of traded shares went down 39.8pc to $36.9m.

Sectors contributing the highest number of points to the benchmark index included fertiliser (57.85 points), cement (53.7 points), technology and communication (50.11 points), engineering (38.66 points) and commercial banking (33.46 points).

Stocks that contributed significantly to the traded volume included Pakistan International Bulk Terminal Ltd (12.58m shares), TPL Properties Ltd (11.08m shares), Ghani Global Holdings Ltd (10.81m shares), First National Equities Ltd (10.58m shares) and Cnergyico PK Ltd (10.2m shares).

Shares contributing positively to the index included Systems Ltd (33.48 points), Engro Corporation Ltd (30.38 points), Lucky Cement Ltd (26.88 points), Colgate-Palmolive Pakistan Ltd (21.67 points) and International Steels Ltd (18.24 points).

Stocks that took away the maximum number of points from the index included Pakistan Tobacco Company Ltd (22.54 points), K-Electric Ltd (8.02 points), Cnergyico PK Ltd (6.19 points), Murree Brewery Company Ltd (5.07 points) and Pak Suzuki Motor Company Ltd (4.30 points).

Stocks recording the biggest increases in percentage terms included Jahangir Siddiqui and Company Ltd, which went up 7.5pc, followed by International Steels Ltd (7.49pc), Avanceon Ltd (5.75pc), Colgate-Palmolive Pakistan Ltd (5.4pc) and International Industries Ltd (5.04pc).

Foreign investors were net buyers as they purchased securities worth $1.71m.

Published in Dawn, January 4th, 2022