KARACHI: The Pakistan Stock Exchange witnessed on Wednesday a range-bound session owing to investors’ concerns about the spread of the new variant of Covid-19, according to Topline Securities.

The rising number of Omicron cases may lead to lockdowns and scaled-back economic activity going forward. It is spreading at a high pace in Karachi as 339 of the total 464 new cases in Sindh during the preceding 24 hours were reported from the metropolis.

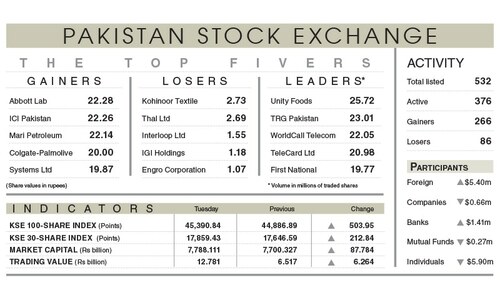

The benchmark index moved within a band of 200 points and closed at 45,407.89 points after adding 17.05 points or 0.04 per cent from a day ago.

Market participation increased 14.91pc to 432.06 million shares while the value of traded shares went down 19.53pc to Rs10.28 billion.

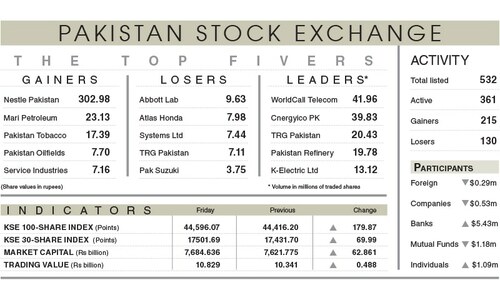

Sectors contributing the highest number of points to the benchmark index included oil and gas marketing (24.74 points), power generation and distribution (23.66 points), investment banking (20.12 points), fertiliser (13.35 points) and tobacco (12.88 points).

Stocks that contributed significantly to the traded volume included WorldCall Telecom Ltd (75.59m shares), Unity Foods Ltd (66.80m shares), TeleCard Ltd (23.80m shares), First National Equities Ltd (20.28m shares) and TRG Pakistan Ltd (15.23m shares).

Shares contributing positively to the index included The Hub Power Company Ltd (30.86 points), Pakistan State Oil Company Ltd (23.12 points), Dawood Hercules Corporation Ltd (21.78 points), Pakistan Oilfields Ltd (15.40 points) and Engro Fertilisers Ltd (13.97 points).

Stocks that took away the maximum number of points from the index included Lucky Cement Ltd (20.50 points), Systems Ltd (14.92 points), Maple Leaf Cement Factory Ltd (12.80 points), Nestle Pakistan Ltd (11.72 points) and Pakistan Petroleum Ltd (9.04 points).

Stocks recording the biggest increases in percentage terms included Yousaf Weaving Mills Ltd, which went up 6.64pc, followed by Pakistan Tobacco Company Ltd (3.73pc), Bannu Woollen Mills Ltd (3.06pc), Interloop Ltd (2.85pc) and Dawood Hercules Corporation Ltd (2.78pc).

Foreign investors were net buyers as they purchased securities worth $5.74m.

APP adds: In a related development, Minister for Information and Broadcasting Chaudhry Fawad Hussain said that with 18 per cent profit, the Pakistan Stock Exchange remained the most profitable among the world’s markets.

The companies listed on the stock market paid dividends amounting to around Rs272 billion to their shareholders in 2020, while their profit touched the mark of Rs498 billion in 2021, he said in a tweet. The minister also shared the list of companies showing remarkable growth in the dividends paid during the last two years.

Published in Dawn, January 6th, 2022