KARACHI: The stock market benchmark inched up on Friday as investors became hopeful about a favourable decision on the loan programme by the International Monetary Fund in its executive board meeting on Jan 12, according to Arif Habib Ltd.

Profit-taking was witnessed in the first trading hour as the positivity ratio for Covid-19 recorded a surge. The fertiliser sector remained in the limelight owing to the expected hike in the urea price while cement stocks stayed under pressure after the uptick in international coal prices.

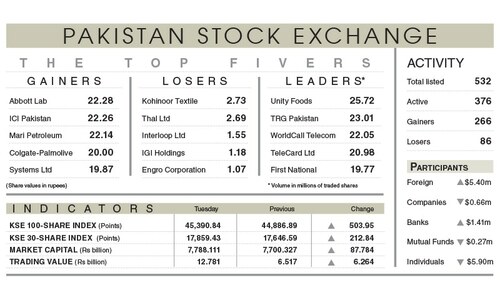

As a result, the benchmark index gained 263.35 points or 0.58pc to close at 45,345.65 points from a day ago.

Market participation decreased 29.8pc to 242.3 million shares while the value of traded shares went down 40.1pc to $44.9m.

Sectors contributing the highest number of points to the benchmark index included commercial banking (107.74 points), fertiliser (96.99 points), power generation and distribution (46.23 points), oil and gas exploration (36.24 points) and food and personal care (11.34 points).

Stocks that contributed significantly to the traded volume included TeleCard Ltd (26.14m shares), WorldCall Telecom Ltd (21.66m shares), TRG Pakistan Ltd (18.99m shares), Unity Foods Ltd (17.01m shares) and Silkbank Ltd (12.28m shares).

Shares contributing positively to the index included The Hub Power Company Ltd (41.92 points), Systems Ltd (39.78 points), Engro Fertiliser’s Ltd (34.62 points), Fauji Fertiliser Company Ltd (33.54 points) and United Bank Ltd (29.63 points).

Stocks that took away the maximum number of points from the index included TRG Pakistan Ltd (96.17 points), Colgate-Palmolive Pakistan Ltd (27.84 points), Dawood Hercules Corporation Ltd (6.44 points), Millat Tractors Ltd (3.34 points) and Gul Ahmed Textile Mills Ltd (3.32 points).

Stocks recording the biggest increases in percentage terms included Azgard Nine Ltd, which went up 4.23pc, followed by Avanceon Ltd (4.14pc), Yousaf Weaving Mills Ltd (3.93pc), Gadoon Textile Mills Ltd (3.85pc) and Jahangir Siddiqui and Company Ltd (3.8pc).

Foreign investors were net sellers as they offloaded securities worth $0.030m.

Published in Dawn, January 8th, 2022