KARACHI: The stock market closed flat on Wednesday because of a lack of triggers. Trading activity remained range-bound with investors resorting to profit-taking across the board, according to Arif Habib Ltd.

The market opened on a positive note and managed to stay in the green zone during the day, with third-tier stocks witnessing high volumes.

“We believe the index can take a short-term correction from the current levels and recommend a buy-on-dips strategy in technology, fertiliser, banking and cyclical stocks,” said JS Global.

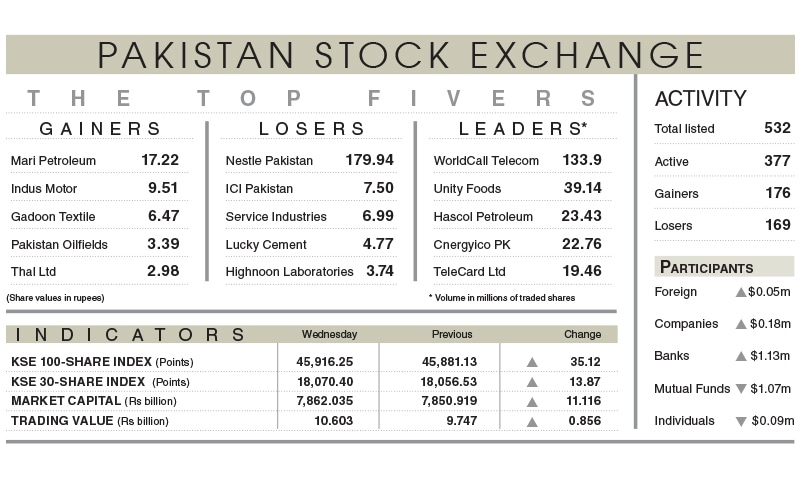

As a result, the benchmark index gained 35.12 points or 0.08pc to close at 45,916.25 points.

Market participation increased 51.7pc to 514.4 million shares while the value of traded shares went up 8.8pc to $60.2m.

Sectors contributing the highest number of points to the benchmark index included oil and gas exploration (53.44 points), fertiliser (21.05 points), textile (10.55 points), power generation and distribution (10.09 points) and investment banking (5.38 points).

Stocks that contributed significantly to the traded volume included WorldCall Telecom Ltd (133.9m shares), Unity Foods Ltd (39.14m shares), Hascol Petroleum Ltd (23.43m shares), Cnergyico PK Ltd (22.76m shares) and TeleCard Ltd (19.46m shares).

Shares contributing positively to the index included Oil and Gas Development Company Ltd (18.43 points), Pakistan Petroleum Ltd (13.23 points), Fauji Fertiliser Ltd (11.86 points), Mari Petroleum Company Ltd (11.12 points) and Pakistan Oilfields Ltd (10.65 points).

Stocks that took away the maximum number of points from the index included TRG Pakistan Ltd (30.75 points), MCB Bank Ltd (16.17 points), Lucky Cement Ltd (13.07 points), Habib Bank Ltd (10.30 points) and Nestle Pakistan Ltd (9.88 points).

Stocks recording the biggest increases in percentage terms included Pakistan Telecommunication Company Ltd, which went up 3.95pc, followed by Azgard Nine Ltd (3.24pc), Gadoon Textile Mills Ltd (2.28pc), Cnergyico PK Ltd (2.08pc) and Bannu Woollen Mills Ltd (1.99pc).

Foreign investors were net buyers as they purchased securities worth $0.055m.

Published in Dawn, January 13th, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.