KARACHI: As many as nine listings on the Pakistan Stock Exchange (PSX) generated a total of Rs30.92 billion in 2021, data obtained from the Securities and Exchange Commission of Pakistan showed.

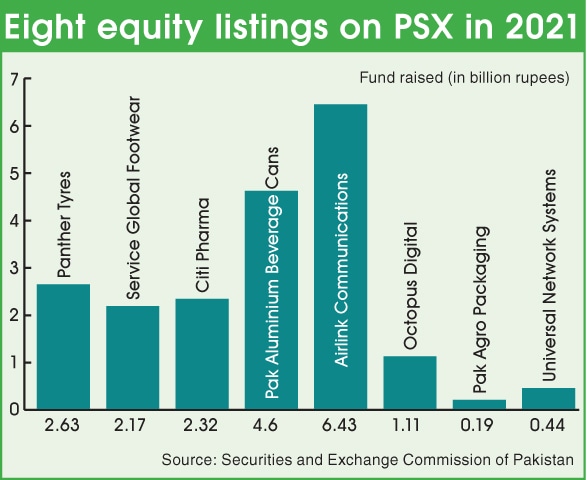

Eight companies raised equity amounting to Rs19.9bn while Bank Alfalah Ltd listed its Rs11bn debt instrument on the PSX in the last calendar year.

Two of the nine listings were on the PSX’s newly established Growth Enterprise Market (GEM) counter, which is reserved for companies that are smaller and riskier than the ones listed on the main board. These two listings were of Pak Agro Packaging Ltd and Universal Network Systems Ltd, which generated Rs198 million and Rs445.7m, respectively.

The largest equity-generating listing in 2021 was of Airlink Communications Ltd (Rs6.4bn), followed by Pakistan Aluminium Beverage Cans Ltd (Rs4.6bn), Panther Tyres Ltd (Rs2.6bn), Citi Pharma Ltd (Rs2.3bn), Service Global Footwear Ltd (Rs2.1bn) and Octopus Digital Ltd (Rs1.1bn).

In addition, transactions of “further issue of capital” on the PSX amounted to a total of Rs61bn in 2021. These included right issues (Rs33.3bn), preference right issues (Rs1.9bn), other than right issues (Rs25.19bn) and employee stock options (Rs450.7m).

Speaking to Dawn, PSX Managing Director Farrukh H. Khan said 2021 witnessed an IPO revival after many years of subdued capital formation on the national bourse. “The number of listings was minimal for some time. Despite a challenging environment and Covid-19–induced lockdowns, I’m happy that we were able to revive the IPO window,” said Mr Khan.

He went on to say that up to five new IPOs are expected before the end of 2021-22 on June 30. “I won’t use the word ‘record’ as we had a lot of IPOs back in the 1990s. But I’m confident that the ongoing fiscal year will see the highest number of IPOs in recent history.

I expect four to five IPOs, or maybe more, by the end of June,” he said.

In addition, two to four new listings on the GEM counter are also expected in the next few months, he added.

Given that four listings have already taken place on the main board and two on the GEM counter since the beginning of 2021-22, the number of new offerings can go up to as high as 13 in the current fiscal year.

“We’ve received many applications. Depending on the macro-economic situation, we expect a lot of activity in coming months,” said Mr Khan.

Published in Dawn, January 16th, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.