KARACHI: Another session of range-bound activity took place on the stock exchange on Monday as investors waited keenly for the interest rate decision by the central bank’s monetary policy committee.

Activity on the main board remained gloomy on the first day of the roll-over week. Third-tier stocks witnessed hefty volumes while value buying took place in the last trading hour owing to the announcement of corporate results.

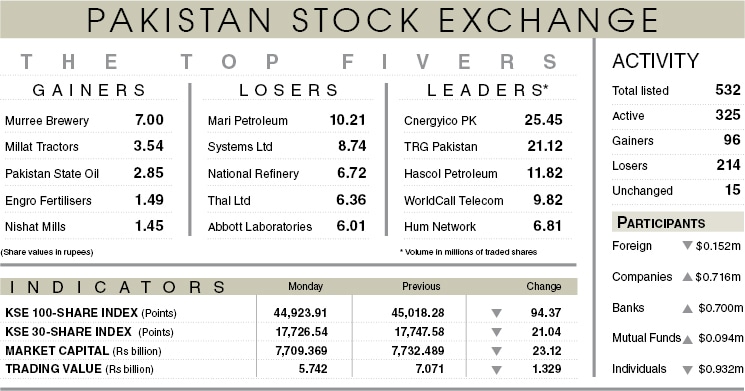

As a result, the benchmark index lost 94.37 points or 0.21 per cent from a day ago to close at 44,923.91 points.

Market participation decreased 0.9pc to 160.2 million shares while the value of traded shares went down 18.8pc to $32.5m.

Sectors that took away the highest number of points from the benchmark index included technology and communication (71.92 points), cement (24.63 points), commercial banking (17.48 points), refinery (13.99 points) and engineering (9.07 points).

Stocks contributing significantly to the traded volume included Cnergyico PK Ltd (25.45m shares), TRG Pakistan Ltd (21.12m shares), Hascol Petroleum Ltd (11.82m shares), WorldCall Telecom Ltd (9.82m shares) and Hum Network Ltd (6.81m shares).

Shares contributing positively to the index included Fauji Fertiliser Company Ltd (23.82 points), Engro Fertilisers Ltd (21.61 points), Pakistan State Oil Company Ltd (14.53 points), The Hub Power Company Ltd (12.68 points) and MCB Bank Ltd (12.12 points).

Stocks that took away the maximum number of points from the index included TRG Pakistan Ltd (52.58 points), Systems Ltd (17.48 points), Habib Bank Ltd (12.22 points), United Bank Ltd (11.94 points) and Cnergyico PK Ltd (7.33 points).

Stocks recording the biggest declines in percentage terms included Bannu Woollen Mills Ltd, which went down 5.91pc, followed by TRG Pakistan Ltd (4.72pc), Kohinoor Textile Mills Ltd (3.98pc), Jahangir Siddiqui and Company Ltd (3.93pc) and Standard Chartered Bank Pakistan Ltd (3.9pc).

Published in Dawn, January 25th, 2022