KARACHI: Trading on the stock exchange began on a positive note on Tuesday after the central bank’s decision to keep the benchmark interest rate unchanged at 9.75 per cent.

The market stayed in the green zone with cement stocks remaining in the limelight on the expectation of high earnings in the upcoming results’ season, according to Arif Habib Ltd.

However, an alarming rise in the number of Covid-19 cases and mounting international oil prices led investors to book profit in the last trading hour.

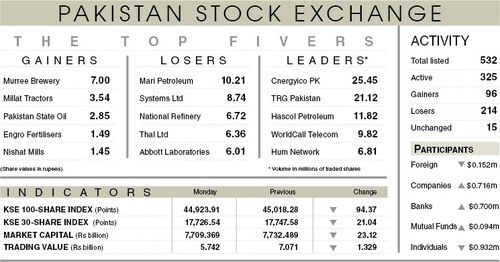

As a result, the benchmark index lost 36.14 points or 0.08 per cent from a day ago to close at 44,887.77 points.

Market participation increased 29.2pc to 207 million shares while the value of traded shares went up 41.3pc to $45.9m.

Sectors that took away the highest number of points from the benchmark index included technology and communication (91.3 points), oil and gas exploration (38.78 points), chemical (21.8 points), insurance (8.49 points) and power generation and distribution (5.76 points).

Stocks contributing significantly to the traded volume included Waves Singer Pakistan Ltd (20.02m shares), TRG Pakistan Ltd (11.11m shares), Treet Corporation Ltd (9.38m shares), Cnergyico PK Ltd (8.82m shares) and WorldCall Telecom Ltd (8.51m shares).

Shares contributing positively to the index included Lucky Cement Ltd (53.85 points), Fauji Fertiliser Ltd (18.41 points), Cherat Cement Company Ltd (13.28 points), Bank Alfalah Ltd (11.41 points) and Maple Leaf Cement Factory Ltd (10.86 points).

Stocks that took away the maximum number of points from the index included TRG Pakistan Ltd (49.18 points), Systems Ltd (41.20 points), Colgate-Palmolive Pakistan Ltd (22.14 points), Engro Corporation Ltd (19.35 points) and Bank AL Habib Ltd (12.56 points).

Stocks recording the biggest declines in percentage terms included Colgate-Palmolive Pakistan Ltd, which went down 5.21pc, followed by TRG Pakistan Ltd (4.64pc), Yousaf Weaving Mills Ltd (3.69pc), Systems Ltd (2.67pc) and Honda Atlas Cars Pakistan Ltd (2.34pc).

Published in Dawn, January 26th, 2022