KARACHI: Stock investors restricted themselves to range-bound trading on Wednesday as the number of coronavirus cases and international oil prices remained on the higher side.

According to Arif Habib Ltd, cement stocks came under pressure after the release of provisional data that reflected an annual decline of 19 per cent in monthly despatches. The fertiliser sector also suffered as Fauji Fertiliser Bin Qasim Ltd hit its lower circuit after a disappointing earnings announcement.

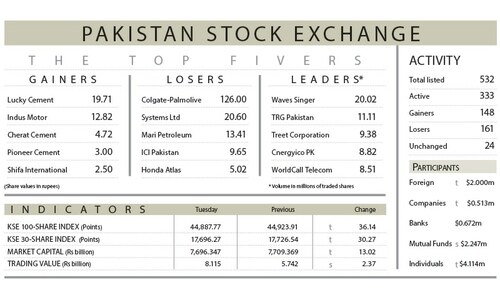

As a result, the benchmark index added 67.28 points or 0.15pc from a day ago to close at 44,955.05 points.

Market participation decreased 33.7pc to 137.3 million shares while the value of traded shares went down 33.9pc to $30.3m.

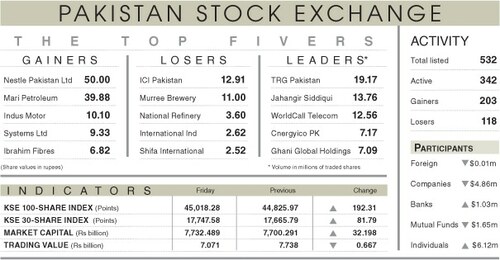

Sectors that contributed the highest number of points to the benchmark index included technology and communication (45.14 points), chemical (25.75 points), commercial banking (20.19 points), investment banking (14.83 points) and cement (10.62 points).

Stocks contributing significantly to the traded volume included TRG Pakistan Ltd (18.8m shares), Ghani Global Holdings Ltd (6.01m shares), TPL Properties Ltd (5.88m shares), WorldCall Telecom Ltd (5.34m shares) and Cnergyico PK Ltd (5.02m shares).

Shares contributing positively to the index included TRG Pakistan Ltd (54.42 points), Colgate-Palmolive Pakistan Ltd (30.22 points), Pakistan Oilfields Ltd (19.99 points), Bank AL Habib Ltd (15.52 points) and The Hub Power Company Ltd (15.27 points).

Stocks that took away the maximum number of points from the index included Fauji Fertiliser Bin Qasim Ltd (21.38 points), Systems Ltd (12.52 points), Fauji Fertiliser Company Ltd (11.66 points), Habib Bank Ltd (10.09 points) and Oil and Gas Development Company Ltd (9.50 points).

Stocks recording the biggest increases in percentage terms included TRG Pakistan Ltd, which went up 7.65pc, followed by Colgate-Palmolive Pakistan Ltd (7.5pc), Kohat Cement Company Ltd (2.55pc), Bank Alfalah Ltd (2.27pc) and Jahangir Siddiqui and Company Ltd (2.18pc).

Published in Dawn, January 27th, 2022