KARACHI: The surging price of oil, which touched $90 a barrel for the first time in seven years owing to tight supplies as well as mounting political tension between Russia and Ukraine, caused across-the-board profit-taking on the Pakistan Stock Exchange on Thursday.

However, range-bound trading gave way to a change in sentiments later on. Investors conducted value-buying towards the end of the session in anticipation of the corporate results’ season, according to Arif Habib Ltd.

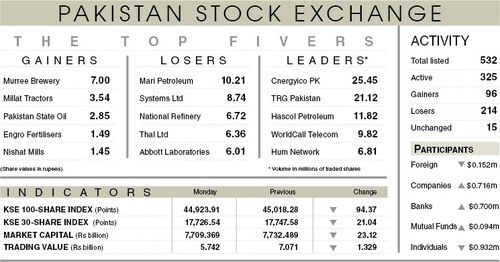

As a result, the benchmark index added 127.99 points or 0.28 per cent from a day ago to close at 45,083.04 points.

Market participation increased 26.4pc to 173.6 million shares while the value of traded shares went up 22.5pc to $37.1m.

Sectors that contributed the highest number of points to the benchmark index included technology and communication (62.74 points), power generation and distribution (28.4 points), commercial banking (22.06 points), miscellaneous (20.92 points) and oil and gas exploration (17.41 points).

Stocks contributing significantly to the traded volume included TRG Pakistan Ltd (19.12m shares), Hum Network Ltd (15.24m shares), Unity Foods Ltd (11.7m shares), WorldCall Telecom Ltd (10.23m shares) and Cnergyico PK Ltd (7.67m shares).

Shares contributing positively to the index included TRG Pakistan Ltd (60.84 points), The Hub Power Company Ltd (22.55 points), Pakistan Services Ltd (20.92 points), Mari Petroleum Company Ltd (19.49 points) and Allied Bank Ltd (16.59 points).

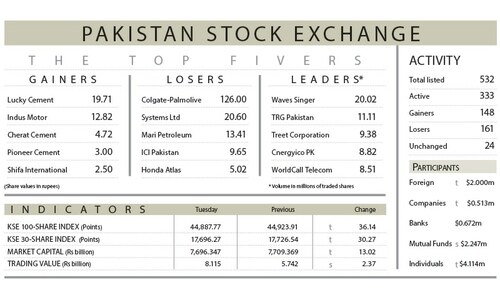

Stocks that took away the maximum number of points from the index included Pakistan Tobacco Company Ltd (15.72 points), Fauji Fertiliser Bin Qasim Ltd (13.09 points), Colgate-Palmolive Pakistan Ltd (11.6 points), Dawood Hercules Corporation Ltd (10.33 points) and Pakistan Petroleum Ltd (6.12 points).

Stocks recording the biggest increases in percentage terms included Archroma Pakistan Ltd, which went up 6.58pc, followed by TRG Pakistan Ltd (5.71pc), Yousaf Weaving Mills Ltd (5.43pc), Allied Bank Ltd (4.71pc) and Unity Foods Ltd (3.93pc).

Foreign investors were net sellers as they offloaded shares worth $0.33m.

Published in Dawn, January 28th, 2022