KARACHI: The foreign investors repatriated $891.2 million during the first half of the current fiscal year, slightly lower than $892.3m in the same period last year.

However, the repatriation of profits and dividends were different from last year as the outflow from sectors and to the countries were changed during FY22.

The details issued by the State Bank of Pakistan (SBP) on Thursday showed that the profit outflow to the United Kingdom was dropped by a massive 46 per cent to $170m compared to the repatriation of $318m in the corresponding period last year.

The other major change was the zero outflows to Malta against $91.7m in the first half of FY21. This helped the country to maintain its profits outflow at the same level of 6MFY21.

SBP data shows the profit outflow to UK fell by a massive 46pc in July-December 2021

The profits outflow to the United States slightly declined to $146.7m compared to $152m in 6MFY21.

Other significant outflows of profits were $90.7m to Switzerland, $54.7m to the United Arab Emirates, $70.5m to The Netherlands and $62.6m to China. The profit repatriation to China improved compared to $36m in the first half of FY21.

The outflows of portfolio investments were higher during the period, indicating the foreign investment is getting a much better return from the equity market. The outflows during the first half were $97.2m compared to $52.2m in the same period of last year.

The profits and dividends outflow was declined by over 17pc to $477.7m during the first quarter of FY22 compared to $576.8m in the same quarter last year. However, the pace of outflows picked up momentum in the second half increasing to $891.2m in 6MFY22, almost what was in 6MFY21.

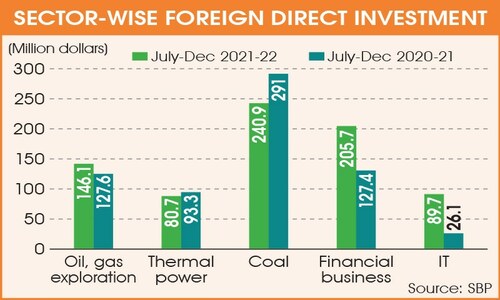

The country attracted foreign direct investments (FDI) of $1.05 billion during July-December FY22, much higher than the outflows in the same period.

However, Pakistan is the lowest recipient of FDI in the region except for Afghanistan while most of the foreign investments are from the UK, US and other western countries. However, for the last few years, the Chinese investments have been increasing and inflows of $306m were noted in the first half of FY22.

The sector-wise data showed that the highest profit outflows were from financial business as it rose to $163.3m against the outflow of $133.5m in the same period of last year.

The second highest outflow was noted from the food sector but was less than the amount repatriated in the same period of last year. The outflow from the food sector in 1st half of FY22 was $106.3m compared to $172.9m of last year.

Outflows from communication declined to $90m compared to $119m last year. Profits outflow increased to $95.1m from the power sector compared to $26m of the previous year. Oil and gas exploration recorded lower outflows of $55.3m in the first half year compared to $73.8m in the same period of last year.

Published in Dawn, January 28th, 2022