KARACHI: Stock trading began on a positive note on Thursday as investors welcomed the approval of the $1 billion loan tranche by the International Monetary Fund (IMF).

However, investors found it difficult to “digest” the physiological level of 46,000 points, said a note by Arif Habib Ltd. Resorting to across-the-board profit-taking, they dragged the benchmark index down to the red zone, with hefty trading taking place in third-tier stocks.

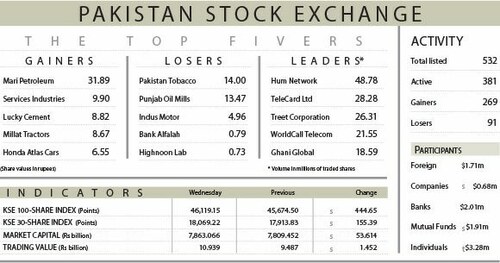

As a result, the KSE-100 index lost 256.22 points or 0.56 per cent to close at 45,862.93 points.

Market participation decreased 9.1pc to 328 million shares while the value of traded shares went down 3.9pc to $59.9m.

Sectors that took away the highest number of points from the benchmark index included miscellaneous (65.81 points), cement (51.61 points), commercial banking (48 points), oil and gas exploration (39.57 points) and power generation and distribution (18.48 points).

Stocks contributing significantly to the traded volume included WorldCall Telecom Ltd (32.82m shares), TeleCard Ltd (20.3m shares), Ghani Global Holdings Ltd (16.8m shares), Hum Network Ltd (16.59m shares) and Treet Corporation Ltd (14.26m shares).

Shares contributing positively to the index included Interloop Ltd (9.34 points), Pakistan Tobacco Company Ltd (9.28 points), Dawood Hercules Corporation Ltd (7.6 points), Engro Fertilisers Ltd (7.58 points) and Shell Pakistan Ltd (7.55 points).

Stocks that took away the maximum number of points from the index included Pakistan Services Ltd (67.58 points), Lucky Cement Ltd (21.43 points), Habib Bank Ltd (20.63 points), Oil and Gas Development Company Ltd (19.71 points) and Fauji Fertiliser Company Ltd (14.76 points).

Stocks recording the biggest declines in percentage terms included Pakistan Services Ltd, which went down 7.5pc, followed by Unity Foods Ltd (3.98pc), International Industries Ltd (3.36pc), Pakistan Stock Exchange Ltd (3.22pc) and Pioneer Cement Ltd (2.96pc).

Foreign investors were net sellers as they offloaded shares worth $0.71m.

Published in Dawn, February 4th, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.