KARACHI: The KSE-100 index on Friday remained mostly in the green zone on the back of positive news flow.

However, profit-taking was observed in the second half of the trading session as the benchmark settled just a little above the preceding day’s close, said Topline Securities.

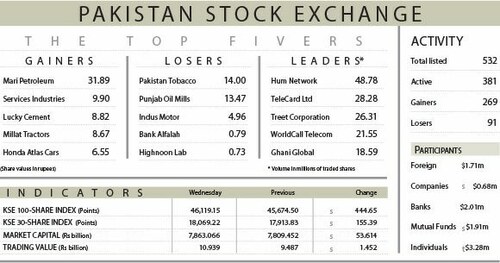

As a result, the KSE-100 index added 46.72 points or 0.1 per cent to close at 45,909.65 points.

Traded volume and value stood at 191 million shares and Rs8.85 billion, respectively.

Sectors that contributed the highest number of points to the benchmark index included oil and gas marketing (38.85 points), fertiliser (24.46 points), automobile assembling (24.05 points), chemical (7.63 points) and commercial banking (5.90 points).

Stocks contributing significantly to the traded volume included WorldCall Telecom Ltd (12.79m shares), TeleCard Ltd (9.68m shares), Ghani Global Holdings Ltd (8.03m shares), Oil and Gas Development Company Ltd (7.93m shares) and First National Equities Ltd (7.91m shares).

Shares contributing positively to the index included Fauji Fertiliser Company Ltd (25.96 points), Millat Tractors Ltd (25.02 points), Pakistan State Oil Company Ltd (24.85 points), Oil and Gas Development Company Ltd (18.31 points) and Shell Pakistan Ltd (12.48 points).

Stocks that took away the maximum number of points from the index included Systems Ltd (22 points), Pakistan Oilfields Ltd (20.53 points), Engro Corporation Ltd (8.53 points), Meezan Bank Ltd (seven points) and EFU General Insurance Ltd (5.69 points).

Stocks recording the biggest increases in percentage terms included Shell Pakistan Ltd, which went up 7.5pc, followed by Adamjee Insurance Company Ltd (3.83pc), Millat Tractors Ltd (3.41pc), Pakistan State Oil Company Ltd (2.55pc) and Interloop Ltd (2.52pc).

Foreign investors were net sellers as they offloaded shares worth $0.52m.

According to JS Global, investors should take advantage of any downside to buy shares in the construction, energy exploration and production and export-oriented sectors.

Published in Dawn, February 5th, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.