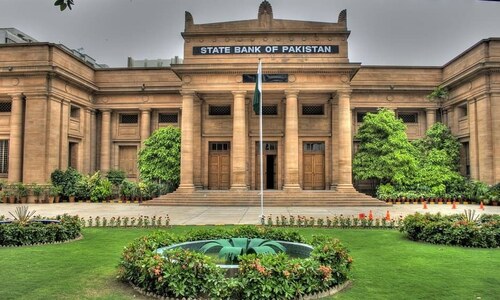

After a long, long wait, the State Bank of Pakistan (SBP) has received autonomy with its struggle for operational freedom apparently not over. Given the fierce controversy with which autonomy has come about, it is generally believed that the SBP would face difficult challenges in making independent decisions.

The question is being asked now is ‘how ready is SBP to deliver on its new role, particularly on low and stable inflation.’ This was the topic of a webinar organised by the Sustainable Development Policy Institute on February 7.

The central bank has no option but to build upon its capacity to make a success of the controversial autonomy and deliver on its mandate.

Referring to the way the SBP bill has been passed by the parliament, a former state bank governor says under such circumstances reforms are not taken seriously. In the same way, to quote an analyst, “the creditability of the SBP and public trust in its various functions and objectives has been adversely affected.” And the situation offers the government the opportunity to informally undermine the SBP’s autonomy as it is its usual practice.

The central bank has no option but to build upon its capacity to make a success of the controversial autonomy and deliver on its mandate

On the central bank’s role in ensuring price stability — a matter of deep national concern — former finance minister Hafiz Pasha says: the past 3-year results showed that in the given model, every year the systematic monetary component in inflation ranged between 30 to 35 per cent. The other two dominant variables are the supply side, imported inflation and, very importantly, administered price and, as of now, electricity tariff is the largest single contributor to inflation in the country.

To reduce imported inflation, described by policymakers as a major cause of price hikes, the State Bank needs to re-direct bank credit to help boost production and build a self-reliant economy. “Since our industries are heavily reliant on imported raw materials and machinery, the abrupt devaluation disrupts the entire business cycle,” says Lahore Chamber of Commerce and Industry President Mian Nauman Kabir.

It needs to be acknowledged here that the central bank has played a significant role in stimulating economic growth and protecting employment following the outbreak of coronavirus.

The International Monetary Fund’s (IMF) sixth review report stressed the need for SBP’s closer oversight of the institutions to ensure they remain well-capitalised to maintain financial stability. The IMF has asked the SBP to take a more proactive approach in addressing the issue of the under-capitalisation of two private banks.

Having helped the SBP to attain autonomy, the IMF is now trying to scale up its reforms in the financial sector that would put the PTI-government in an uncomfortable position. The Fund has urged SBP to unwind two key measures it has taken for promoting housing and construction activities. It says “the banks housing lending targets could present risks to the financial sector and entail a misallocation of credit.”

To spur housing finance, the SBP made it mandatory for banks to increase the share of their lending portfolios to 5pc by December 2021. And in June 2021 capital adequacy regulations were changed to lower applicable risk weight to 100pc from 200pc on banks’ investment in real estate investment trusts.

The central bank has achieved initial success in persuading commercial banks to step up credit to under-served sectors of the economy such as housing and construction with lending risks shared by government subsidy. On this issue, the government and the SBP are on the same page.

So far it looks that the IMF and the government aren’t on the same page, says Fahad Rauf, head of research at Ismail Iqbal Securities, adding, “Let’s see how the SBP acts going forward as it has become autonomous now.”

Though the IMF has a different view in terms of housing finance, Deputy Governor Dr Murtaza Syed says it is not part of the Fund’s conditionality and is just advice — and we can agree to disagree on this.

While the country faces a shortage of four million houses, Dr Pasha says the increase in the interest rate on home financing by SBP is absolutely not justified, adding it was okay at 2-4pc.

The issues in banks’ management and work culture demand closer SBP’s supervision. For example, in a dispute resolved by the Banking Mohtasib Pakistan (BMP), a bank was found unjustifiably avoiding repatriation of stuck up export proceeds to the complainant. In another case relating to a customer’s investment in a mutual fund, it came to light that the bank staff had no clue about the SBP directive regarding the ‘Sale of Third Party Products by Banks.’ In the quarter ending December 31, 2021, the central bank slapped a penalty of Rs57.8m on five commercial banks for “violation of regulatory instructions pertaining to general banking operations.”

A positive development is that the number of complaints relating to inefficiencies/delays and classified as ‘others’ has dropped from 3,869 in 2020 to 3,645 in 2021, according to the annual BMP report. At the same time disputes related to customers’ products (credit)/debit cards, personal /auto loans etc fell from 2,323 to 2,104. However the total number of complaints received by BMP — including from the prime minister’s office — swelled from 22,750 to 33,196.

With the impetus provided by Covid-19, the State Bank has taken significant steps to improve the quality of banking service by accelerating the digitalisation of the banking system. But the number of complaints relating to the promotion of digitalisation has increased from 1,546 to 1,905 and those relating to internet banking, e-commerce etc from 1,345 to 1,543.

The indemnity granted to its officials and board of directors under the new law would require SBP to strengthen its internal accounting system, increase its overall efficiency and performance as an autonomous institution.

The number of cases resolved amicably with the approval of BMP in 2021 was 25,231 and orders issued were a mere 437. In all, 6,924 cases were found to be incomplete/not related/ required further information/documents. On December 31, 2021, there were 4,772 pending cases against 4,168 at the end of 2020.

BMP’s success can be attributed primarily to its charter. BMP is independent, impartial and autonomous — administratively and financially — to resolve disputes amicably through an informal and friendly process in a manner that is impartial, fair and equitable to all parties.

Published in Dawn, The Business and Finance Weekly, January 14th, 2022