KARACHI: The benchmark index of the Pakistan Stock Exchange closed on Wednesday slightly lower than a day ago amid investors’ concerns about inflationary pressures. Trading remained range-bound in response to the government’s decision to increase the prices of all petroleum products by Rs10-12 to pass on the impact of higher international oil prices.

According to Topline Securities, the stock market recorded a 20-month low in terms of the value of shares traded.

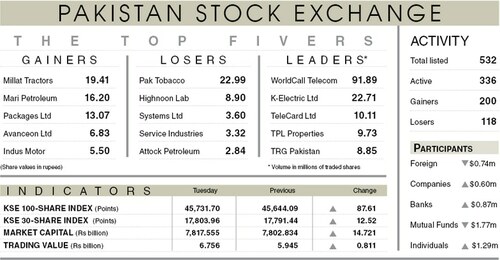

As a result, the KSE-100 index lost 46.9 points or 0.1 per cent on a day-on-day basis to close at 45,684.80 points.

The trading volume decreased 47.1pc to 145.3 million shares while the traded value went down 38.8pc to $23.5m on a day-on-day basis.

Sectors that took away the highest number of points from the benchmark index included commercial banking (28.11 points), cement (28.04 points), oil and gas marketing (12.38 points), oil and gas exploration (6.02 points) and sugar and allied industries (4.46 points).

Stocks contributing significantly to the traded volume included K-Electric Ltd (23.64m shares), WorldCall Telecom Ltd (17.05m shares), Faysal Bank Ltd (10.13m shares), Hum Network Ltd (7.45m shares) and Bank of Punjab Ltd (5.86m shares).

Shares contributing positively to the index included Engro Corporation Ltd (10.71 points), Meezan Bank Ltd (8.9 points), Millat Tractors Ltd (8.82 points), The Hub Power Company Ltd (7.57 points) and Pakistan Oilfields Ltd (6.09 points).

Stocks that took away the maximum number of points from the index included Habib Metropolitan Bank (15.48 points), Habib Bank Ltd (11.05 points), Lucky Cement Ltd (11.01 points), Askari Bank Ltd (8.09 points) and Maple Leaf Cement Factory Ltd (7.81 points).

Stocks recording the biggest declines in percentage terms on a day-on-day basis were Shakarganj Ltd (6.46pc), Askari Bank Ltd (4.1pc), Standard Chartered Bank Pakistan Ltd (3.1pc), Habib Metropolitan Bank Ltd (2.93pc) and Feroze1888 Mills Ltd (2.51pc).

Foreign investors were net sellers as they offloaded shares worth $0.18m.

Published in Dawn, February 17th, 2022