KARACHI: The conflict between Russia and Ukraine cast a pall of gloom on the stock market where trading began on a negative note in the outgoing week, according to Arif Habib Ltd.

Although the market took some respite after the media reported Russian troops were withdrawing from Ukraine’s border, investors’ sentiments remained subdued throughout the week. The primary reason for the poor sentiments was an increase in local petroleum prices, which prompted concerns about inflation.

A 93 per cent jump in the trade deficit in the first seven months of 2021-22 fuelled pessimism in the shares market. Less-than-expected earnings announced by some companies further deteriorated the momentum.

In contrast, the passage of the Oil and Gas Regulatory Authority (Amendment) Bill and the Weighted Average Cost of Gas Bill by the Senate kept the shares of exploration companies, gas utilities and some of the oil marketing firms in the limelight — a development that somewhat offset the overall dip in stock prices.

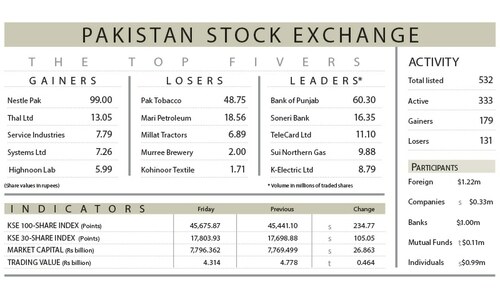

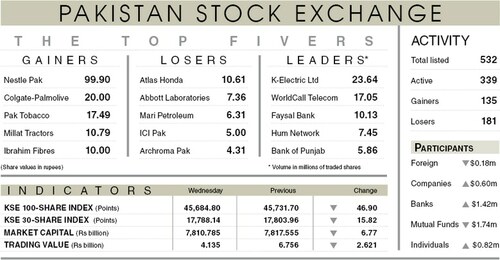

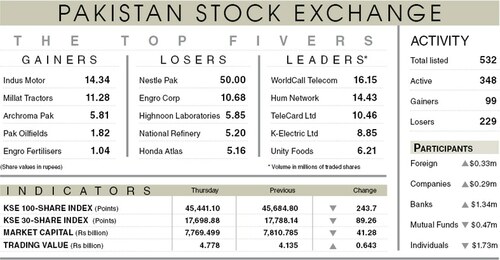

As a result, the benchmark index closed at 45,676 points after losing 403 points. In percentage terms, the week-on-week drop in share prices was 0.9pc.

Sector-wise, negative contributions came from commercial banking (88 points), fertiliser (68 points), power generation and distribution (66 points), technology and communication (39 points) and cement (37 points).

Sectors that contributed positively were automobile assembling (nine points), chemical (nine points) and oil and gas exploration (five points).

Scrip-wise, negative contributors were The Hub Power Company Ltd (67 points), Engro Corporation Ltd (62 points), Meezan Bank Ltd (36 points), Systems Ltd (35 points) and Dawood Hercules Corporation Ltd (34 points).

Positively contributing top shares were Engro Fertilisers Ltd (55 points), Sui Northern Gas Pipelines Ltd (24 points) and Millat Tractors (22 points).

According to AKD Securities, an improving situation on the Russia-Ukraine border along with the expectation of a renewal of the Iranian oil deal has brought down global fuel prices by around 3.5pc.

“Other commodity prices are also following these developments with the TRJ Commodity Index down 0.7pc. The sustainability of these trends should contribute to improving market sentiments in our view,” the brokerage said in a note.

Published in Dawn, February 20th, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.