KARACHI: Political unrest and higher commodity prices resulted in volatility in the shares market on Wednesday.

According to Arif Habib Ltd, the cement sector faced pressure owing to higher coal prices in the international market. United Bank Ltd was in the limelight after it announced better-than-expected financial results. Value hunting was observed in the last trading hour, which led to a recovery in the shares market. Trading continued to be sideways as the market witnessed hefty volumes in third-tier stocks.

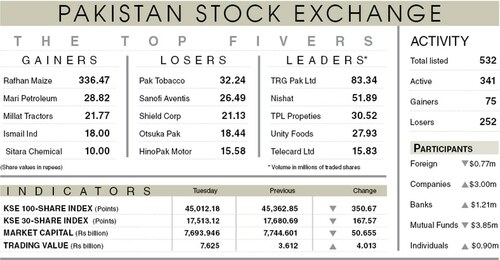

As a result, the KSE-100 index gained 120.74 points or 0.27pc on a day-on-day basis to close at 45,132.92 points.

The trading volume decreased 18pc to 186.4 million shares while the traded value went down 10.8pc to $38.6m on a day-on-day basis.

Sectors that contributed the highest number of points to the benchmark index included cement (69.29 points), commercial banking (48.03 points), automobile assembling (19.13 points), tobacco (11.59 points) and technology and communication (11.38 points).

Stocks contributing significantly to the traded volume included Bank of Punjab Ltd (13.62m shares), TeleCard Ltd (12.29m shares), WorldCall Telecom Ltd (11.55m shares), Maple Leaf Cement Factory Ltd (10.58m shares) and TPL Properties Ltd (9.42m shares).

Shares contributing positively to the index included United Bank Ltd (57.97 points), Maple Leaf Cement Factory Ltd (25.83 points), Mari Petroleum Company Ltd (18.81 points), Habib Metropolitan Bank Ltd (16.62 points) and Millat Tractors Ltd (15.22 points).

Stocks that took away the maximum number of points from the index included Meezan Bank Ltd (21.66 points), Nishat Mills Ltd (11.69 points), Engro Corporation Ltd (10.09 points), Pakistan Oilfields Ltd (9.44 points) and Colgate-Palmolive Pakistan Ltd (8.85 points).

Stocks recording the biggest increases in percentage terms on a day-on-day basis were HBL Growth Fund Ltd (7.89pc), Maple Leaf Cement Factory Ltd (6.79pc), Dolmen City REIT (5pc), Fauji Cement Company Ltd (4.53pc) and Fatima Fertiliser Company Ltd (4.36pc).

Foreign investors were net buyers as they purchased shares worth $0.53m.

Published in Dawn, February 24th, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.