KARACHI: Trading in the shares market began on Friday on a positive note amid expectations of the status quo in the monetary policy announcement due on March 8, according to Arif Habib Ltd.

A majority of analysts polled by Topline Securities said they expected no change in the benchmark interest rate. The last monetary policy announced on Jan 24 maintained the interest rate at 9.75 per cent — a decision that was in line with “forward guidance” that the SBP had previously provided.

The benchmark index remained range-bound throughout the day, although investors resorted to value-buying in the last trading hour.

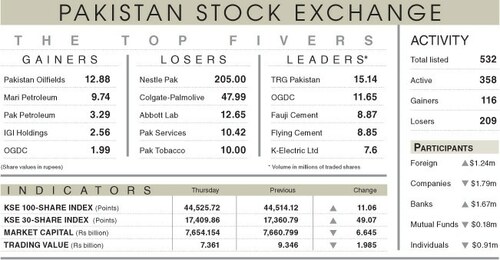

As a result, the KSE-100 index added only 25.63 points or 0.06pc on a day-on-day basis to close at 44,551.35 points.

The trading volume decreased 28.6pc to 134.8 million shares while the traded value went down 35.7pc to $26.7m on a day-on-day basis.

Sectors that contributed the highest number of points to the benchmark index included fertiliser (62.31 points), cement (22.41 points), technology and communication (19.6 points), commercial banking (10.22 points) and chemical (7.85 points).

Stocks contributing significantly to the traded volume included Flying Cement Ltd (11.41m shares), TRG Pakistan Ltd (8m shares), Yousuf Weaving Mills Ltd (6.6m shares), WorldCall Telecom Ltd (5.66m shares) and Ghani Global Holdings Ltd (4.77m shares).

Shares contributing positively to the index included Systems Ltd (30.43 points), Habib Bank Ltd (19.8 points), Engro Corporation Ltd (19.73 points), Engro Fertilisers Ltd (17.98 points) and Fatima Fertiliser Company Ltd (15.94 points).

Stocks that took away the maximum number of points from the index included The Hub Power Company Ltd (24.38 points), Pakistan Oilfields Ltd (16.2 points), Indus Motor Company Ltd (16.15 points), MCB Bank Ltd (14.13 points) and Pakistan State Oil Company Ltd (11.25 points).

Stocks recording the biggest increases in percentage terms on a day-on-day basis were Fatima Fertiliser Company Ltd (5.51pc), Pioneer Cement Ltd (2.66pc), Cherat Cement Company Ltd (2.58pc), Systems Ltd (2.42pc) and Aisha Steel Mills Ltd (2.06pc).

Published in Dawn, March 5th, 2022