KARACHI: The benchmark index of the Pakistan Stock Exchange (PSX) registered the highest day-on-day increase in points on Monday as investors celebrated the end of political uncertainty.

Breaching the psychological barrier of 46,000 points, the KSE-100 index added 1,700 points following the ouster of the PTI from the federal government over the weekend. The previous record of the highest daily gain was of 1,566 points on June 5, 2017.

Ismail Iqbal Securities Head of Research Fahad Rauf said the index added a record number of points in a day at the mere “hint of clarity” in the political situation. Good times lie ahead if the reforms process is initiated and global lenders are brought on board, he said.

Independent economist Ammar H. Khan had a different take on the rapid rise in share prices though. “Short-term equity gains are as deceptive as someone selling a magic potion outside Empress Market. Political uncertainty is only going to increase further, which affects sovereign risk,” he said.

He told Dawn the deficit position on both fiscal and external fronts doesn’t look good either. Inflation is only going to increase further if fuel subsidies are phased out, he added.

According to Jehanzaib Zafar AKD Securities, the momentum will continue in the near term given that the market is currently trading at a price-to-earnings multiple of only 4.5. “The coalition government plans to continue the stalled International Monetary Fund programme which, we believe, is a welcome step. However, its actual implementation remains to be seen with elections around the corner,” he said.

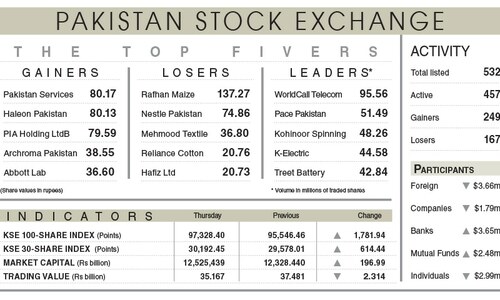

The KSE-100 index settled at 46,144.96 points, up 1,700.38 points or 3.83pc from a day ago.

The trading volume jumped 144.7 per cent to 557.7 million shares while the traded value went up 195.2pc to $73m on a day-on-day basis.

Stocks contributing significantly to the traded volume included WorldCall Telecom Ltd (140.79m shares), Cnergyico PK Ltd (40.14m shares), Fauji Cement Ltd (18.17m shares), Hum Network Ltd (17.8m shares) and Pakistan International Bulk Terminal Ltd (17.15m shares).

Sectors that contributed the highest number of points to the benchmark index included commercial banking (385.38 points), cement (228.49 points), technology and communication (199.35 points), fertiliser (129.8 points) and oil and gas exploration (117.13 points).

Shares contributing most positively to the index included Systems Ltd (99.48 points), Lucky Cement Ltd (96.06 points), TRG Pakistan Ltd (76.44 points), Habib Bank Ltd (75.68 points) and The Hub Power Company Ltd (74.69 points).

Stocks that took away the maximum number of points from the index included Indus Motor Company Ltd (3.07 points), First Habib Modaraba Ltd (0.9 points), Allied Bank Ltd (0.64 points), Dolmen City REIT Ltd (0.55 points) and Nestle Pakistan Ltd (0.51 points).

Shares that increased the most in percentage terms were Pakistan International Bulk Terminal Ltd (16.64pc), Cnergyico PK Ltd (15.38pc), Yousaf Weaving Mills Ltd (11.76pc), Azgard Nine Ltd (7.89pc) and Attock Refinery Ltd (7.5pc).

Foreign investors were net buyers as they purchased shares worth $1.43m.

Published in Dawn, April 12th, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.