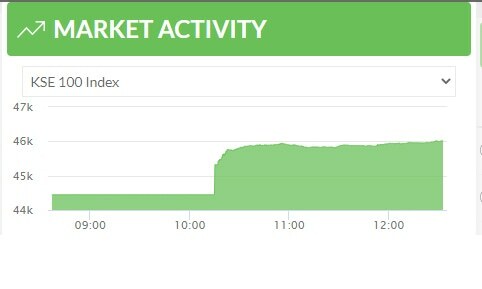

KARACHI: The benchmark index of the Pakistan Stock Exchange (PSX) closed on a negative note on Wednesday as trading stayed range-bound with the KSE-100 index making an intraday high of 235 points and low of 344 points.

According to Topline Securities, profit-taking occurred across the board with major decliners being cement, banking and technology stocks.

“Reports of over $30 billion financing needs in 2022-23 and uncertainty over International Monetary Fund terms to resolve the balance of payments crisis played a catalyst’s role in the bearish close,” said Ahsan Mehanti of Arif Habib Corporation.

As a result, the KSE-100 index settled at 46,165.50 points, down 241.76 points or 0.52 per cent from a day ago.

The trading volume decreased 3.9pc to 474.6 million shares while the traded value went down 10.9pc to $67.9m on a day-on-day basis.

Stocks contributing significantly to the traded volume included Flying Cement Ltd (80.73m shares), WorldCall Telecom Ltd (42.73m shares), Ghani Global Holdings Ltd (32.52m shares), TeleCard Ltd (24.94m shares) and TPL Properties Ltd (23.99m shares).

Sectors that took away the highest number of points from the benchmark index included cement (93.02 points), commercial banking (62.93 points), food and personal care (16.49 points), investment banking (15.74 points) and engineering (15.55 points).

Shares contributing most negatively to the index included Lucky Cement Ltd (35.32 points), United Bank Ltd (29.62 points), Bank AL Habib Ltd (14.45 points), AGP Ltd (13.32 points) and Maple Leaf Cement Factory Ltd (11.35 points).

Stocks that contributed the highest number of points to the index included The Hub Power Company Ltd (16.09 points), Millat Tractors Ltd (14.08 points), The Searle Company Ltd (12.59 points), Pakistan Tobacco Company Ltd (8.66 points) and Meezan Bank Ltd (7.53 points).

Shares that decreased the most in percentage terms were Punjab Oil Mills Ltd (7.5pc), AGP Ltd (6.82pc), Pioneer Cement Ltd (5.12pc), HBL Growth Fund Ltd (4.4pc) and Cnergyico PK Ltd (3.81pc).

Foreign investors were net buyers as they purchased shares worth $0.97m.

Published in Dawn, April 14th, 2022