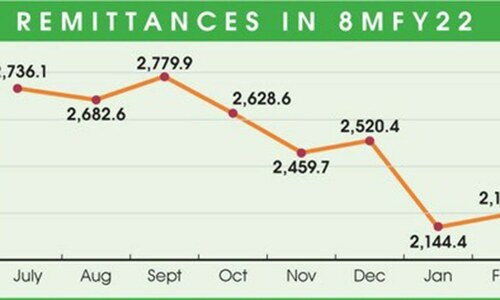

KARACHI: Overseas Pakistanis sent a record $23 billion in remittances in the first nine months of the current fiscal year, while the inflows of $2.8bn in March alone were also historic.

The State Bank of Pakistan (SBP) reported on Thursday this ($2.8bn) is the highest-ever monthly level for workers’ remittances. In terms of growth, remittances increased 28.3 per cent month-on-month and 3.2pc year-on-year in March.

The record increase in remittances has partially reduced the burden of the rising current account deficit which reached $12bn in the first 8 months of FY22.

The PTI government had targeted over $30bn in remittances in 2021-22, which looks possible as the higher inflows in the last quarter of the current fiscal year are expected.

Inflows of $23bn in 9MFY22 also all-time high

The overseas Pakistanis have been sending a higher amount of remittances since the emergence of the Pandemic in 2020 and the inflows remained intact with an encouraging growth rate.

“With $2.8bn of inflows in March, workers’ monthly remittances unprecedentedly remained above $2bn since June 2020,” said the SBP.

Cumulatively at $23bn, remittances grew by 7.1pc in the July-March period of FY22 compared with last year. Pakistan was in serious trouble with the widening trade and current deficit while the imports could not be controlled despite many steps taken by the just ousted PTI government.

The imports grew by 49pc during the current fiscal year so far. The previous government had been holding the high oil prices as the main reason for higher import bills. The oil prices remained over $100 per barrel most of the time in FY22.

The inflows of dollars from Saudi Arabia were the highest with $5.809bn while it noted a growth of 1.2pc in 9MFY22. Pakistan relies heavily on Saudi Arabia for remittances while other Arab countries cumulatively contribute over 60pc of the total remittances for Pakistan.

Recently, the inflows of remittances rapidly increased from the European Union totalling $2.504bn in 9MFY22, a growth of 28.3pc compared to the same period last year.

Similarly, the inflows from Australia and Canada are also taking shape as the remittances from the two counties reached over half a billion dollars each in 9MFY22 with a growth rate of 28pc and 29pc, respectively.

The 2nd highest inflows were noted from the United Arab Emirates as the remittance reached $4.283bn despite negative growth of 5.3pc compared to the same period of last year.

The inflows from the UK and the United States noted a growth of 9.7pc and 20.8pc at $3.187bn and $2.211bn, respectively.

The overseas Pakistanis sent $2.665bbn from the Gulf Cooperation Council states during the same period registering a growth of 8.3pc. Analysts believe the last quarter of FY22 may not reflect any change of government in Pakistan since the remittances are sent by the overseas Pakistanis to their families and for investment in properties and houses.

SBP reserves fall

The foreign exchange reserves of the State Bank of Pakistan further declined by $470 million during the week ended on April 8.

The SBP reported that its reserves decreased mainly due to external debt repayments.

The country’s overall reserves fell to $17.028bn, while the holdings of the commercial banks stood $6.178bn during the week under review.

Published in Dawn, April 15th, 2022