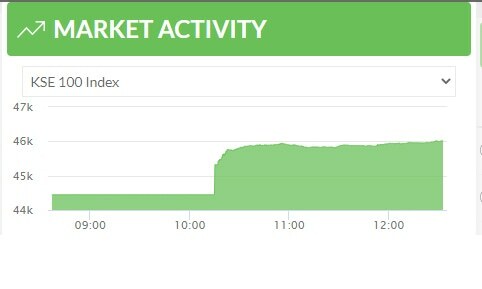

KARACHI: The stock market witnessed another bearish session on Wednesday as the benchmark failed to keep itself in the green zone following profit-taking.

According to Arif Habib Ltd, the KSE-100 index slipped to the red zone owing to the weakening of the rupee against the dollar. The local currency depreciated 0.8 per cent to 185.92 against the greenback on a day-on-day basis.

The trading session remained dull while hefty volumes were recorded in third-tier stocks, the brokerage said.

As a result, the KSE-100 index settled at 45,943.16 points, down 390.2 points or 0.84pc from a day ago.

The trading volume increased 2.8pc to 235 million shares while the traded value went down 9.4pc to $43.1m on a day-on-day basis.

Stocks contributing significantly to the traded volume included Cnergyico PK Ltd (23.76m shares), TPL Properties Ltd (15.7m shares), Ghani Global Holdings Ltd (14.76m shares), Maple Leaf Cement Factory Ltd (12.46m shares) and Telecard Ltd (10.58m shares).

Sectors that took away the highest number of points from the benchmark index included commercial banking (98.34 points), cement (87.53 points), oil and gas exploration (67.22 points), fertiliser (45.66 points) and power generation and distribution (20.74 points).

Shares contributing most negatively to the index included Habib Bank Ltd (70.99 points), Pakistan Petroleum Ltd (28.89 points), Maple Leaf Cement Factory Ltd (28.41 points), Meezan Bank Ltd (27.32 points) and Oil and Gas Development Company Ltd (26.16 points).

Stocks that contributed most positively to the index included United Bank Ltd (23.03 points), TRG Pakistan Ltd (18.45 points), Lotte Chemical Pakistan Ltd (12.43 points), EFU General Insurance Ltd (10 points) and Engro Polymer and Chemicals Ltd (9.81 points).

Shares that registered the largest declines in percentage terms were Maple Leaf Cement Factory Ltd (6.09pc), Pak Elektron Ltd (5.14pc), Frieslandcampina Engro Pakistan Ltd (4.88pc), Mughal Iron and Steel Industries Ltd (3.39pc) and Habib Bank Ltd (3.38pc). Foreign investors were net buyers as they purchased shares worth $0.87m.

Published in Dawn, April 21st, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.