KARACHI: Trading on the Pakistan Stock Exchange remained range-bound on Wednesday with the KSE-100 index staying volatile throughout the session amid expectations about an interest rate hike in the upcoming monetary policy announcement.

According to Arif Habib Ltd, a rally in the refinery sector was also witnessed following the rumours about the approval of the refinery policy. The last trading hour witnessed across-the-board profit-selling, which caused the index to close in the red zone.

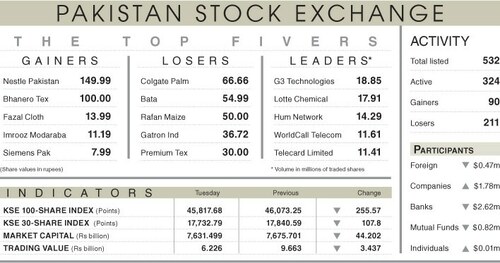

As a result, the KSE-100 index settled at 45,533.30 points, down 284.38 points or 0.62 per cent from a day ago.

The trading volume increased 6.5pc to 210.2 million shares while the traded value went down 10.3pc to $30.1m on a day-on-day basis.

Stocks contributing significantly to the traded volume included Cnergyico PK Ltd (63.68m shares), Pakistan Refinery Ltd (26.16m shares), G3 Technologies Ltd (11.27m shares), Pak Elektron Ltd (10.16m shares) and Telecard Ltd (8.99m shares).

Sectors that took away the highest number of points from the benchmark index included fertiliser (106.76 points), technology and communication (61.73 points), cement (39.5 points), chemical (34.83 points) and investment banking (33.31 points).

Shares contributing most negatively to the index included Fauji Fertiliser Company Ltd (82.82 points), Systems Ltd (43.42 points), Dawood Hercules Corporation Ltd (34.64 points), Engro Polymer and Chemicals Ltd (26.96 points) and The Hub Power Company Ltd (36.35 points).

Stocks that contributed most positively to the index included Cnergyico PK Ltd (22.45 points), Habib Metropolitan Bank Ltd (19.04 points), Bank AL Habib Ltd (9.78 points), MCB Bank Ltd (9.05 points) and Attock Refinery Ltd (6.78 points).

Shares that registered the largest declines in percentage terms were Engro Polymer and Chemicals Ltd (3.96pc), Dawood Hercules Corporation Ltd (3.94pc), Fauji Fertiliser Company Ltd (3.72pc), Frieslandcampina Engro Pakistan Ltd (3.69pc) and Pak Suzuki Motor Company Ltd (3.66pc).

Foreign investors remained net sellers as they offloaded shares worth $0.064m.

Published in Dawn, April 28th, 2022