Bears were in firm control of the Pakistan Stock Exchange (PSX) on Monday as the benchmark KSE-100 index shed 1,447.67 points while the dollar continued its flight towards record levels against the rupee.

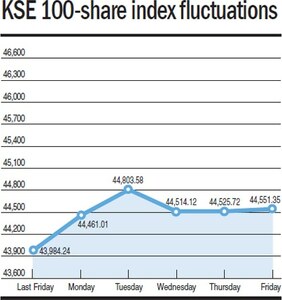

According to the PSX website, the KSE-100 Index opened at 44,840.81 points and made a high of 44,841.41 points before going down rapidly. The bourse took brief corrections but eventually continued with its downward trajectory and closed at 43,393.14 points, which represented a decline of 1,447.67 points.

Raza Jafri, head of Equities at Intermarket Securities, said the market was under pressure because of the depletion of foreign reserves and delay in the resumption of the International Monetary Funds programme (IMF) among other factors.

"The government has seemingly, so far, drawn a blank when it comes to securing funds from friendly countries. The pressure in global equity markets is also hurting sentiment," he explained, cautioning that in the near future the market would track progress on the foreign reserves, hence, positive developments on this front could help halt the slide.

Khurram Shehzad, CEO of Alpha Beta Core, shared a similar opinion.

"No development on funding from Saudi Arabia, UAE and the IMF has worried investors," he said, adding that the Shehbaz government's reluctance in passing on the petrol subsidy could also be one of the reasons for the "PSX bloodbath".

Muhammad Sohail, CEO at Topline Securities, said the stock exchange was witnessing a slump due to which the benchmark index had fallen by more than 1,500 points.

Speaking to Dawn.com, he said investors had become fearful after reports suggested that talks with the IMF would resume after May 18. He added that the government was also not ready to abolish the subsidy on petroleum products which was putting pressure on the economy.

"The risk of interest rates rising in the next monetary policy is also propelling investors to exit the equity market," he said.

Rupee depreciates as dollar touches Rs188.05

Meanwhile, the dollar was trading at Rs188.5 in the interbank at around noon on Monday as the rupee depreciated by Rs1.25, according to the Forex Association of Pakistan. The open market rate of the greenback was Rs187.8 at the same time.

The dollar's highest level against rupee remains Rs189.25 — a level that was seen on April 1 when the political turmoil was at its apex. In the immediate aftermath of the change in government, it had gone down in the face of the rupee's strengthening but the correction soon ran out of steam and now the greenback is soaring back to its record high.

Malik Bostan, chairman of the Forex Association of Pakistan, attributed today's hike in dollar price to payments made for imported oil.

"We are hopeful that rupee will recover by the last week of May," he said, advising the Ministry of Finance to immediately publicise details of the package Pakistan has received from Saudi Arabia.

During Prime Minister Shehbaz Sharif's visit to Saudi Arabia earlier this month, Saudi Crown Prince Mohammed bin Salman agreed to discus extending the term of a $3 billion loan to help Pakistan’s new government tide over the prevailing economic crisis.

Saudi Arabia had affirmed its continuous support to Pakistan and its economy, including discussion of augmenting $3bn deposit with the central bank through term extension or otherwise, and exploring options to further enhance the financing of petroleum products and supporting the economic structural reforms for the benefit of Pakistan and its people.