KARACHI: Stocks made a recovery in a range-bound session on Tuesday amid speculations about a favourable outcome of the country’s economic managers’ meeting with the International Monetary Fund (IMF) officials due next week.

According to Ahsan Mehanti of Arif Habib Corporation, institutional support in a few oversold stocks in fertiliser, banking and oil sectors as well as reports about the likely release of $1 billion IMF loan tranche played the role of a catalyst in the positive close.

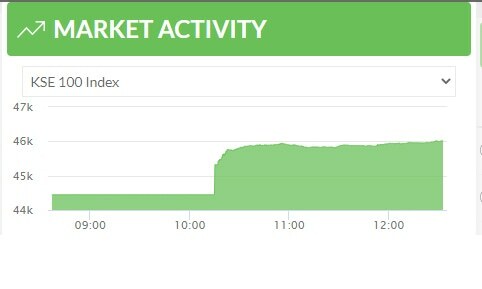

As a result, the benchmark settled at 43,504.36 points, up 111.22 points or 0.26 per cent from a day ago.

The trading volume decreased 23.4pc to 233.9 million shares while the traded value went down 25.7pc to $36.4m on a day-on-day basis.

Stocks contributing significantly to the traded volume included Cnergyico PK Ltd (19.09m shares), Pakistan Refinery Ltd (13.86m shares), Pakistan International Bulk Terminal Ltd (13.19m shares), Lotte Chemical Pakistan Ltd (12.42m shares) and Telecard Ltd (12.15m shares).

Sectors that contributed the highest number of points to the benchmark index included fertiliser (40.66 points), technology and communication (27.63 points), chemical (16.76 points), oil and gas marketing (12.72 points) and power generation and distribution (10.84 points).

Shares contributing most positively to the index included TRG Pakistan Ltd (43.89 points), Colgate-Palmolive Pakistan Ltd (26.92 points), Pakistan Oilfields Ltd (23.57 points), Engro Corporation Ltd (19.07 points) and Fauji Fertiliser Company Ltd (17.62 points).

Stocks that contributed most negatively to the index included Systems Ltd (17.78 points), Habib Bank Ltd (14.04 points), MCB Bank Ltd (11.7 points), Millat Tractors Ltd (10.85 points) and Maple Leaf Cement Factory Ltd (9.46 points).

Shares that registered the largest increase in percentage terms were Colgate-Palmolive Pakistan Ltd (7.16pc), TRG Pakistan Ltd (5.13pc), Shifa International Hospitals Ltd (4.49pc), HBL Growth Fund (3.64pc) and Attock Refinery Ltd (3.37pc).

Foreign investors were net sellers as they offloaded shares worth $1.16m.

Published in Dawn, May 11th, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.