KARACHI: Investors’ confidence returned to the shares market on Friday on the back of record-high monthly remittances in April and the expected approval of up to $2 billion loan from the Asian Development Bank.

According to Faisal Shaji of Standard Capital Securities, the ongoing talks between the coalition government and the International Monetary Fund (IMF) for the continuation of the loan programme may immediately ease the pressure off the balance of payments and strengthen the rupee in the short term.

“There’re vibes among the investing community that the newly formed government may search for other sources to generate revenues, including stake sales in state-owned enterprises namely Oil and Gas Development Company Ltd and Pakistan Petroleum Ltd,” he said.

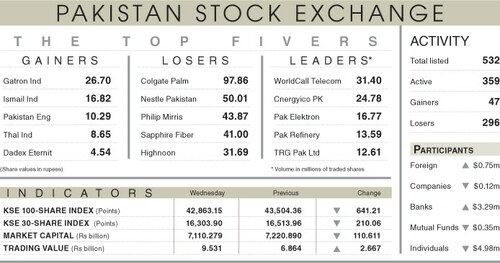

As a result, the KSE-100 index settled at 43,486.46 points, up 588.02 points or 1.37 per cent from a day ago.

The trading volume decreased 26.9pc to 208.1 million shares while the traded value went down 10.6pc to $36.2m on a day-on-day basis.

Stocks contributing significantly to the traded volume included Treet Corporation Ltd (20.9m shares), Cnergyico PK Ltd (20.89m shares), Pakistan Refinery Ltd (14.95m shares), Lotte Chemical Pakistan Ltd (11.69m shares) and WorldCall Telecom Ltd (8.64m shares).

Sectors that contributed the highest number of points to the benchmark index included commercial banking (136.12 points), oil and gas exploration (126.98 points), cement (48.89 points), automobile assembling (46.65 points) and investment banking (36.75 points).

Shares contributing most positively to the index included Oil and Gas Development Company Ltd (50.95 points), Pakistan Petroleum Ltd (38.44 points), Millat Tractors Ltd (36.75 points), Pakistan Oilfields Ltd (36.31 points) and Bank AL Habib Ltd (35.61 points).

Stocks that contributed most negatively to the index included TRG Pakistan Ltd (17.84 points), IGI Holdings Ltd (4.5 points), Bank Alfalah Ltd (3.44 points), National Foods Ltd (2.96 points) and Avanceon Ltd (1.72 points).

Shares that registered the largest increases in percentage terms were Shakarganj Ltd (7.5pc), Punjab Oil Mills Ltd (7.5pc), Pioneer Cement Ltd (6.58pc), Interloop Ltd (6.45pc) and Attock Refinery Ltd (6.43pc).

Published in Dawn, May 14th, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.